Preparing a business in New Jersey for sale can be complex, but a clear CFO checklist makes the process easier and more profitable.

A chief financial officer’s careful preparation helps owners present clean financials, achieve a realistic business valuation, and attract serious buyers.

This approach ensures that business owners are ready for buyer questions and due diligence.

It makes the sales process smoother from start to finish.

A CFO knows how to highlight value drivers and create a solid forecast and transition plan.

These steps help a business stand out in the market and ensure there are no surprises during the sale.

If a business doesn’t have a full-time CFO, a fractional CFO or outside advisor can often step in to deliver the same value.

Key Takeaways

- A CFO checklist guides profitable business sales.

- Clean financial records and strong business value are key.

- Planning for due diligence and transition helps close deals.

Step 1 – Clean Up Your Financials

Having accurate, organized, and complete financial records is one of the most important steps in preparing a New Jersey business for sale.

Buyers and advisors use financial data to assess value and gauge the business’s potential.

Ensure Accuracy And Transparency

CFOs must check all financial statements for errors and correct them before starting the sale process.

Accurate income statements, balance sheets, and cash flow reports build trust with buyers and expedite the due diligence process.

Transparency also means disclosing any unusual one-time items, such as lawsuits, insurance payouts, or tax issues, instead of hiding them in the numbers.

Clear reporting of all numbers, including revenue and costs, makes the business easier to understand.

Using an outside accountant or an independent audit helps verify the accuracy of financial reporting.

This extra step can reduce buyer concerns and build confidence in the financial performance.

Standardize Chart Of Accounts

A standardized chart of accounts ensures every transaction is recorded in the proper place.

This makes it easier for buyers and their advisers to review financial performance, spot trends, and compare results from year to year.

CFOs should consolidate duplicate accounts, eliminate unnecessary codes, and maintain consistent account names across periods.

If multiple companies are being consolidated, map each account so that everything aligns across all entities.

Standardizing categories for revenues, cost of goods sold, and operating expenses enhances clarity in analytics and financial reporting.

Consistency across the chart of accounts also helps to highlight key financial metrics, such as gross margin and EBITDA.

Deliver 3–5 Years Of Historical Financials

Most buyers expect access to at least three to five years of historical financial statements.

Providing clear and well-organized data helps buyers analyze financial trends, growth rates, and any significant changes over time.

Financials should include full income statements, balance sheets, and cash flow statements for each year.

Detailed schedules for revenue, expenses, and debt should also be included, as buyers need these details for financial modeling and valuation.

Organizing historical documents by fiscal year, along with any relevant notes, allows buyers to do side-by-side comparisons.

Keeping these records ready saves time during due diligence and presents the business as well-managed.

Planning to sell your business in the next year? Start with a Free Financial Health Assessment from Coastal Business Services. Contact us now to identify financial gaps early.

If you’re ready to get started, call us now!

Step 2 – Get A Realistic Valuation

A precise business valuation is crucial for making informed decisions during a sale.

Knowing key financial figures and the local market ensures the business is priced right for buyers and investors.

Know Your EBITDA And Add-Backs

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

It measures a company’s core profitability.

Buyers and investors use EBITDA to assess the business’s profitability by excluding certain expenses.

The process starts by calculating solid EBITDA figures for the past few years.

Add-backs are adjustments made to EBITDA to show true earnings.

These include one-time expenses, owner salaries above market value, or personal expenses that are not reimbursable.

Accurate add-backs give a more honest view of profits and help avoid disputes during due diligence.

Recording add-backs clearly in a table can help:

| Year | EBITDA | Add-backs | Adjusted EBITDA |

| 2022 | $320,000 | $48,000 | $368,000 |

| 2023 | $340,000 | $60,000 | $400,000 |

Showing these numbers upfront supports a smoother mergers and acquisitions process and increases confidence in the company’s return on investment (ROI).

Benchmark Against New Jersey Market

A realistic business value depends on how the company compares to others in New Jersey.

Business owners should review regional sale prices, industry multiples, and trends.

This helps establish a fair price, neither too high nor too low.

Utilizing professional business valuation services in New Jersey can provide valuable insights into what buyers are currently paying for similar companies.

Local experts are familiar with the market’s unique factors and can recommend accurate valuation methods, ranging from asset-based approaches to comparing recent transactions.

Relying on New Jersey market data sets realistic expectations, making the business more attractive to qualified buyers, and supporting better negotiations during the sale.

Step 3 – Improve Key Value Drivers

A business is more attractive to buyers when its financial health, processes, and team are not dependent on a single person.

It is essential to generate recurring revenue, identify and manage operational risks, and ensure the business operates smoothly without the owner’s direct involvement.

Strengthen Recurring Revenue And Margins

Recurring revenue, such as subscription sales or long-term contracts, makes a company’s cash flow more predictable and stable.

Buyers often value this consistency because it reduces uncertainty about future earnings.

Improving gross margins through better cost management, pricing strategies, and cost optimization also increases profitability and market position.

Some ways to boost recurring revenue include signing multi-year contracts, increasing customer loyalty programs, and creating automatic renewal services.

Monitoring key performance indicators, such as customer retention and churn rate, helps identify any problems early.

Higher margins and strong recurring sales demonstrate that the business can grow and scale effectively.

They also provide a solid value proposition to buyers.

Reduce Owner Dependence

A business that relies heavily on its owner for daily operations, financial management, or strategic decision-making can be risky for buyers.

To solve this, it is essential to document key processes and establish a management team that can lead effectively without constant owner input.

Delegating tasks, creating clear job descriptions, and training staff on operational processes builds confidence for a smooth transition.

Buyers are likely to pay more for a company that operates efficiently with minimal owner involvement.

Independent finance operations and teams that understand key performance indicators and unit economics make the business more scalable and valuable.

Using checklists and regular reviews helps ensure that no critical knowledge or role is left with just one person.

Identify Operational Risks

Operational risks can hinder revenue growth, increase costs, and compromise scalability.

It is important to identify these risks early using current data, audits, and risk assessment tools.

Common risks include supply chain disruptions, loss of key customers, compliance failures, or outdated technology.

Once risks are identified, owners should develop action plans to mitigate them.

This may involve diversifying suppliers, investing in technology upgrades, or establishing backup plans for critical roles.

Regularly reviewing cost management and strategic initiatives can help keep risk under control and improve financial health. Tracking risks enables quick decisions in the event of problems arising.

A simple, practical checklist of key value drivers can support these efforts and keep the business ready for sale.

Buyers scrutinize cash flow before making offers. Coastal Business Services offers a tailored Cash Flow Analysis to help New Jersey businesses maximize their value. Reach out today.

If you’re ready to get started, call us now!

Step 4 – Prepare For Buyer Due Diligence

Serious buyers in New Jersey will review the company’s financial data, operations, customer contracts, and compliance practices.

Making these records available quickly and securely gives buyers confidence and helps avoid unwanted surprises.

Create A Virtual Data Room

A virtual data room is an online storage space where documents are shared with buyers and their advisors.

Most sellers utilize this tool to organize files and manage access control.

The deal team should upload financial statements, tax returns, customer contracts, regulatory permits, and insurance records.

Data security is a priority. Only authorized parties should access confidential documents.

All files should be clearly labeled and up to date. Adding watermarking and tracking features helps protect sensitive information.

Organizing folders by topic or year makes it easier for buyers to locate key details without delay.

A well-structured virtual data room can expedite the due diligence process and demonstrate professionalism.

It builds trust with buyers by showing the seller is organized and transparent.

Conduct Internal Financial Due Diligence

Before sharing financial data, the company should review its records for accuracy and completeness.

The CFO should ensure all entries match source documents and reconcile accounts.

Outstanding issues, such as unreconciled bank statements or incomplete revenue recognition, should be addressed before any disclosure.

Checking customer contracts for proper documentation and term details reduces the need for back-and-forth communication with buyers.

Review compliance with regulatory requirements, including licenses and tax filings, to ensure adherence to relevant laws and regulations.

If the company handles sensitive customer data, double-check cybersecurity measures and document them for the buyer.

Maintaining clear and well-documented financial processes helps explain any past corrections or inconsistencies to buyers.

Preparing answers to potential questions from the buyer’s team enables a smoother transaction and reduces delays.

Step 5 – Build A Strong Forecast And Transition Plan

Accurate forecasting and a clear transition plan help a business avoid surprises during the sales process.

Buyers want to see reliable financial projections and a well-structured exit strategy from the CFO.

Deliver A 1–3 Year Financial Forecast

A detailed financial forecast outlines the business’s projected performance over the next one to three years.

The CFO should use past financial data, market trends, and known risks to create projections that include key profit-and-loss figures, cash flow, and balance sheet items.

This process often involves financial modeling using spreadsheets or financial software.

The forecast should focus on both revenue and expenses, breaking them down by product lines or business units.

A straightforward budgeting process should back up every assumption. It may be helpful to include best-case, base-case, and worst-case scenarios.

Presenting numbers in easy-to-read tables or charts adds clarity.

A strong forecast can support the business’s valuation during due diligence and help answer a buyer’s detailed questions.

Create An Owner Exit Roadmap

An owner exit roadmap details the steps that the CFO and owner must take before, during, and after the sale.

This plan outlines key milestones, including cleaning up the company’s financials, gathering legal documents, and preparing staff for the change.

The roadmap should also state the timing of the owner’s exit, the new leadership structure, and the plan for transferring relationships with customers and vendors.

Financial planning and analysis play a key part in identifying risks or gaps that could delay or reduce the value of a sale.

Using a checklist can help track progress and keep everything organized.

This exit plan should be easy for a buyer to understand and must address regulatory requirements in New Jersey.

The State of New Jersey provides a helpful checklist for business transitions, outlining local requirements.

Pro Tip: Want a clear roadmap for your sale prep? Use our downloadable CFO Business Sale Preparation Checklist to track every step—from financial clean-up to buyer due diligence.

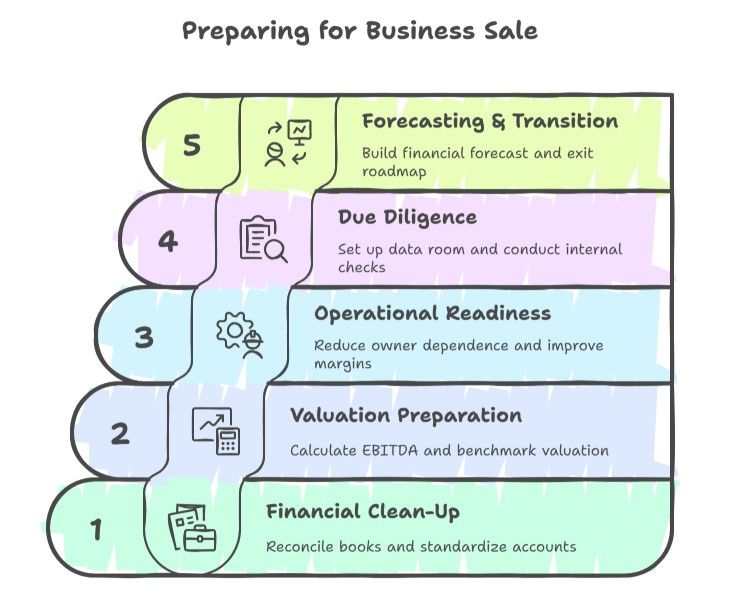

| Category | Action Item |

| Financial Clean-Up | Reconcile books and fix any accounting errors |

| Standardize the chart of accounts across all periods. | |

| Prepare 3–5 years of financial statements (P&L, Balance Sheet, Cash Flow) | |

| Valuation Preparation | Calculate EBITDA and document all add-backs (e.g., owner salary, one-time costs) |

| Benchmark valuation against New Jersey market data and recent industry sales | |

| Operational Readiness | Reduce owner dependence by documenting key processes and delegating responsibilities |

| Increase recurring revenue and improve gross margin. | |

| Identify and address operational risks (supply chain, key client loss, tech gaps) | |

| Due Diligence | Set up a virtual data room containing contracts, tax documents, licenses, and insurance documents. |

| Conduct internal due diligence to catch red flags before buyers do | |

| Forecasting & Transition | Build a 1–3 year financial forecast with revenue, cost, and cash flow projections. |

| Create an owner exit roadmap that includes a transition timeline, roles, and customer handoff plans. |

Why A Fractional CFO Is A Game-Changer In Business Exits

A fractional CFO delivers professional financial oversight and planning during the business sale process.

Their expertise helps business owners make informed decisions, optimize value, and control costs.

Strategic Guidance Without The Full-Time Cost

Fractional CFOs give businesses access to high-level financial guidance without adding a full-time salary to the payroll.

Owners can bring in an expert who understands financial modeling, due diligence, and buyer expectations, but only pay for the hours and expertise needed.

A fractional CFO reviews key financial statements, prepares budgets, and ensures records are clean and accurate, which builds buyer confidence.

Their skills are valuable for overseeing audit preparation, managing cash flow, and identifying risks before they become issues.

Many New Jersey businesses also face fundraising or capital needs before a sale.

A fractional CFO helps the executive team assess funding options and negotiate with banks or investors, creating a stronger financial story and ensuring maximum business value at exit.

Coastal Business Services’ Exit Planning Support

Coastal Business Services offers fractional CFO support tailored for exit planning and preparation.

Their team analyzes the entire finance function to find ways to streamline operations and enhance financial reporting.

This ensures potential buyers see precise, well-structured numbers.

Support includes building exit timelines, setting up tracking for key metrics, and preparing presentations for buyers and investors.

Coastal works alongside the executive team to respond to questions and negotiate details, guiding the company through each step.

This approach means business owners receive custom advice on pricing strategies, deal terms, and transition planning.

By utilizing a fractional CFO from Coastal, companies can benefit from expert guidance without hiring a full-time executive, saving money while reducing risk and stress during the sale process.

Conclusion

A CFO plays a crucial role in preparing a business for sale. Careful financial planning can help avoid delays and build trust with buyers.

A straightforward sales process helps keep things organized and efficient. It is a good idea to create a checklist to track important documents and tasks.

It is essential to understand and comply with all applicable laws and regulations. For example, selling a business in New Jersey may require following the Bulk Sales Act and notifying the state.

Want to exit with confidence? Coastal Business Services provides a Growth Readiness Review to align your financials with buyer expectations. Schedule your session with us now.

If you’re ready to get started, call us now!

Frequently Asked Questions

What does a CFO do to prepare a business for sale?

A CFO ensures accurate financial records, builds forecasts, supports due diligence, and helps improve key metrics like EBITDA to increase business value before a sale.

What financial documents are needed when selling a business?

Buyers typically request 3–5 years of financial statements, tax returns, cash flow reports, and supporting documentation, such as contracts, leases, and asset lists.

How far in advance should I prepare my business for sale?

You should start preparing 12 to 24 months before listing your business to optimize value and fix any financial or operational gaps.

What increases the value of a small business before selling?

Recurring revenue, strong margins, low owner dependence, clean financials, and diversified customer sources increase a business’s market value.

What is adjusted EBITDA, and why is it important?

Adjusted EBITDA reflects your business’s true profitability by removing one-time expenses or discretionary costs. Buyers rely on it to assess core earnings potential.

How does a fractional CFO help in business exit planning?

A fractional CFO supports valuation, financial cleanup, audit preparation, and builds buyer-ready forecasts, providing strategic support without the full-time cost.