A cash flow crisis can hit your New Jersey business fast and leave you feeling overwhelmed. Tight cash, missed payments, and mounting stress are warning signs you can’t ignore.

You can take control in just 30 days with a focused recovery plan that stops the crisis and positions your company for a stronger comeback.

Understanding the common causes of cash flow problems and taking prompt action can prevent minor issues from escalating into major problems.

If you’re not sure where to start, don’t worry—this article shows you the steps to assess your situation, protect your business, and make smart financial decisions every week.

You’ll learn proven methods for recovery and tips for lasting financial health that apply to any unpredictable economy.

Key Takeaways

- Recognize early signs of cash flow issues for faster response

- Use weekly actions to recover and stabilize your finances

- Build habits that protect your business from future crises

Understanding The Root Of A Cash Flow Crisis

Fixing a cash flow problem begins with understanding why it occurred. You need to examine your business’s numbers and daily operations more closely to identify the issue and prevent it from happening in the future.

The Difference Between Profitability And Liquidity

Profitability and liquidity are distinct concepts. You might show profit on paper, but still struggle to pay your bills.

Profitability means your business generates more revenue than it incurs in expenses over time. Liquidity, on the other hand, measures whether you have enough cash on hand to cover your day-to-day costs.

Many New Jersey business owners get caught off guard because they focus on profit and ignore their bank balance.

Here’s an example: If you send out invoices for services in April but don’t get paid until June, you could run out of money before the payments come in.

This gap is where many service businesses in New Jersey need targeted cash flow help. For effective cash flow management in New Jersey, it is essential to monitor both your overall profit and your actual cash position every week.

Common Triggers In New Jersey Businesses

Several factors can lead to a cash flow crisis, especially for local service businesses. Major triggers include unexpected drops in sales, slow customer payments, and sudden spikes in expenses.

Seasonal demand changes are also common across New Jersey. For example, a landscaping company may earn most of its income in the summer and struggle during the winter.

Other risks include new competitors entering the market or clients canceling contracts without notice.

Many New Jersey businesses also face high property taxes and compliance costs, which can put additional strain on their cash reserves.

To improve your financial health, it’s critical to identify which of these issues is causing your cash crunch.

Cash flow solutions for New Jersey businesses often begin with identifying and addressing these specific trouble spots.

Facing a cash crunch? Coastal Business Services offers a Free Financial Health Assessment for New Jersey businesses. Contact us now to pinpoint issues and start recovery.

If you’re ready to get started, call us now!

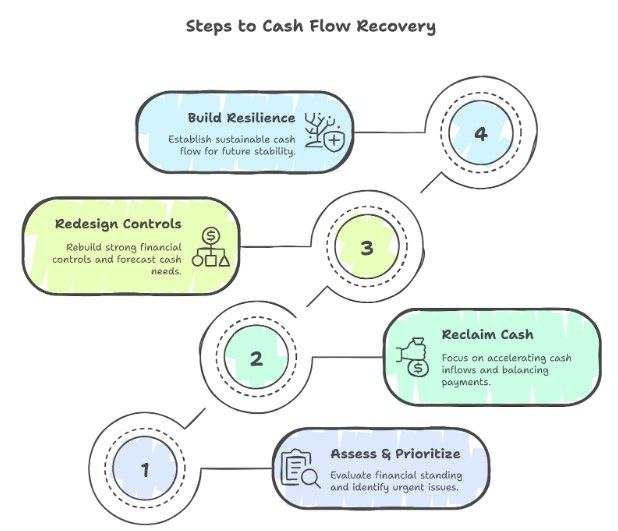

Week 1 – Assess, Prioritize, And Stop The Bleed

Swift action is critical in the first week of your cash flow crisis recovery plan. Focus on determining your financial standing, identifying any urgent issues, and communicating promptly with those who rely on your business.

Conduct A 48-Hour Cash Position Audit.

Begin by building an accurate picture of your real-time cash position. Gather the balances for every bank account, tally up all expected income over the next 48 hours, and list every payment due immediately.

Use a simple table to organize this information:

| Source | Amount In | Amount Out |

| Bank Account 1 | $8,000 | $4,000 |

| Bank Account 2 | $5,500 | $1,000 |

| Customer Payment Due | $3,000 | — |

| Payroll | — | $6,800 |

Add up the money you have and subtract what you owe right away. The result will indicate whether you have a positive or negative position.

This quick snapshot forms the foundation of your emergency financial plan for businesses and sets priorities for the rest of your recovery checklist.

Identify Immediate Cash Drains

Identify all outgoing payments and expenses that threaten your available cash. Scan for high-cost vendors, overdue bills, recurring subscriptions, and upcoming payroll.

Rank each expense by urgency and impact. For example, payroll and key supplier payments often take priority, while discretionary spending, such as travel or non-essential purchases, can be temporarily paused.

Renegotiate payment terms or seek discounts to reduce the outflow where possible. Taking action to resolve cash flow problems quickly may involve delaying less critical expenditures or offering incentives for early customer payments.

The goal is to slow or halt unnecessary drains and stabilize your cash position quickly.

Alert Key Stakeholders

Once you understand your financial position and have identified cash drains, notify your key stakeholders immediately. This includes owners, leadership, banks, main suppliers, and sometimes even staff.

Be transparent but calm in your communication. Share the steps you are taking to recover from the cash flow crisis fast and ask for support or flexibility if needed.

This could include requesting delayed payments or renegotiating loan terms. Clear, early communication builds trust and gives your partners time to help you.

Keeping important people updated is an essential part of any cash flow recovery checklist, as it helps maintain stability during a crisis.

Week 2 – Reclaim Cash And Rebalance Inflows

Focusing on getting your money in faster and balancing your payments when they are due can help you improve your cash flow within 30 days.

Taking calculated steps now prevents the situation from worsening and gives your New Jersey business the breathing room it needs while you address negative cash flow.

Accelerate Receivables

Review your list of outstanding invoices. Make personal calls or send friendly reminders to customers with overdue payments.

Offer small discounts for prompt payments, such as 2% off if paid within ten days. This can encourage customers to settle invoices quickly.

If customers consistently miss deadlines, consider adjusting your payment terms to require partial payment upfront or shorter payment periods.

Digital invoicing tools help you track and automate reminders, enabling you to follow up with everyone without missing anyone.

Clear communication and quick follow-up are essential during a cash flow crunch. Focus on your larger customers first, where collecting a few key payments could make the biggest impact.

Consider pausing new work for clients with large outstanding bills until they settle their accounts.

Renegotiate Payment Terms

Contact your vendors and suppliers. Politely explain that you are going through a short-term cash flow management plan and need better terms, such as an extension from 15 days to 30 or 45 days.

This can spread out your outflows, giving you extra time to collect receivables. Suppliers may offer alternative payment schedules, split payments, or even temporary discounts if you maintain a good relationship and communicate early.

Prepare your requests with clear reasons and specific asks, not just general appeals. Keep a written record of all new agreements.

Updating your cash flow plan with these new payment dates will help you avoid missing due dates in the weeks ahead.

Consider Short-Term Lending (With Caution)

If the gap between money coming in and money owed is too large, you might need outside funds to stabilize.

Consider short-term business loans, lines of credit, or merchant cash advances, but carefully assess the interest rates and fees associated with each option.

Only borrow what you know you’ll be able to pay back in the next few months. Ensure that new debt doesn’t harm your long-term business health.

Use a table to compare offers:

| Lender | Loan Type | Repayment Term | Interest Rate | Fees |

| Local Bank | Line of Credit | 12 months | 7% | $100 |

| Online Lender | Short-Term Loan | 6 months | 15% | $250 |

| Credit Union | Term Loan | 12 months | 8.5% | $50 |

Get advice if you’re unsure which financing option is best for you. Using lending as a bridge only works if you have a realistic plan to repay and know your improved cash flow in 30 days will cover the commitment.

Week 3 – Redesign Your Financial Controls

Rebuilding strong financial controls is key to surviving a cash flow crisis. In this phase, you will focus on forecasting your cash needs and making sure your spending supports what matters most to your business’s success.

Set Up Weekly Cash Flow Forecasting

A detailed cash flow projection for a small business enables you to identify shortfalls before they occur. Use a basic spreadsheet or accounting software for tracking on a week-to-week basis.

Include all inflows (like customer payments, loans, and grants) and all outflows (such as rent, payroll, and supplier expenses). Update this forecast every week.

Review your actual cash movements against your projection. Adjust quickly if any payments are late or new bills appear.

Regular monitoring makes it easier to catch warning signs early. List overdue invoices and expected payments in order of priority.

This helps you focus your collection efforts. Make it a routine to contact customers with outstanding balances regularly.

Address problems promptly and increase your chance of getting paid on time.

Align Budget With Real-Time Priorities

During a crisis, your budget should be nimble and respond to current business needs.

Compare your weekly spending against urgent goals, such as retaining top employees, meeting key supplier terms, and maintaining crucial sales activities.

Create a table to rank expenses by importance and cut or delay non-essential costs:

| Expense | Priority | Action |

| Payroll | High | Maintain |

| Marketing Ads | Medium | Reduce |

| Office Upgrades | Low | Delay |

Update your budget after reviewing your cash forecast. Direct funds toward activities that protect your core business and cash position.

Stay flexible. As your situation improves or changes, rebalance your spending to match your short-term and long-term priorities.

Week 4 – Build A Resilient Cash Flow Foundation

In the final week, focus on making your cash flow sustainable, especially as New Jersey businesses face ongoing changes.

Strong cash flow requires both flexibility and better financial oversight for future stability.

Adjust Your Business Model (If Needed)

If your current model no longer meets market needs, this is the time to adapt. Evaluate your sales methods, pricing, and core products or services to ensure they align with your business goals.

Some companies improve cash flow by shifting to online sales, updating service packages, or offering discounts for faster payment.

List your revenue streams and look for areas where you can reduce costs or speed up cash collection.

Develop a business continuity cash flow plan that accounts for potential downturns, emerging customer behaviors, and regulatory updates to ensure a robust financial strategy.

This ensures your company can handle surprises without risking daily operations.

Create a rolling 90-day forecast to help anticipate future cash needs.

These forecasts help you spot trouble before it starts and are part of many business cash flow turnaround tips. Staying flexible keeps you one step ahead in uncertain times.

Assign A Fractional CFO To Monitor Cash Flow

Even if you have a solid plan, expert oversight can make a difference.

A fractional CFO works part-time to give you financial insight without hiring a full-time executive.

Their experience helps you tighten spending, manage cash reserves, and spot risks early.

Fractional CFO cash flow services include weekly reviews, forecasting, and setting clear policies for billing and collections.

They help maintain cash discipline, enforce budgeting, and build your cash buffer for emergencies.

Their outside perspective reveals blind spots and suggests new strategies for managing liquidity.

Adding this level of part-time CFO cash flow support gives your business ongoing guidance.

With the right expert on your team, you can maintain a stable cash position, support growth, and avoid falling into old patterns.

Don’t let delayed receivables or rising expenses sink your business. Get a personalized Cash Flow Analysis from Coastal Business Services today. Reach out to build your 30-day plan.

If you’re ready to get started, call us now!

Coastal’s 30-Day Cash Flow Recovery Snapshot

Cash flow challenges demand focused, practical solutions. You need clear steps and real results to keep your New Jersey business stable in uncertain times.

Real Example From A NJ Service Business

A local New Jersey cleaning service experienced significant declines in demand following a sudden market shift.

Instead of resorting to panic cuts, management implemented a 30-day cash flow recovery strategy modeled after Coastal Business Services’ cash flow strategy.

Their plan used weekly tracking to monitor every dollar in and out. They adjusted their invoicing process to shorten the gap between completed jobs and payments.

This created a more reliable inflow of cash.

The company contacted overdue clients directly, offering small discounts for early payments.

They adjusted work schedules to align labor costs with actual production volume rather than relying on assumptions.

By day 20, they had improved receivables by 18%. Strategic choices, like pausing less profitable routes instead of broad layoffs, helped stabilize operations.

ROI Of Cash Flow Strategy Vs Reactive Cuts

The returns from following a structured cash flow plan are measurable.

Compared to quick, reactive cost-cutting measures, a methodical 30-day cash flow recovery strategy can provide more lasting benefits.

Quick Comparison Table

| Approach | Short-Term Result | Longer Benefit |

| Reactive Cuts | Fast initial savings | Team morale drops, risk of losing clients |

| Strategic Recovery | Steady cash improvements | Client loyalty, stable workforce |

You build trust with clients and staff by prioritizing steady cash flow over sudden cuts.

Regular review of payables and receivables pinpoints real problems sooner.

This can lead to lower turnover and improved vendor relationships over time, making your business more durable.

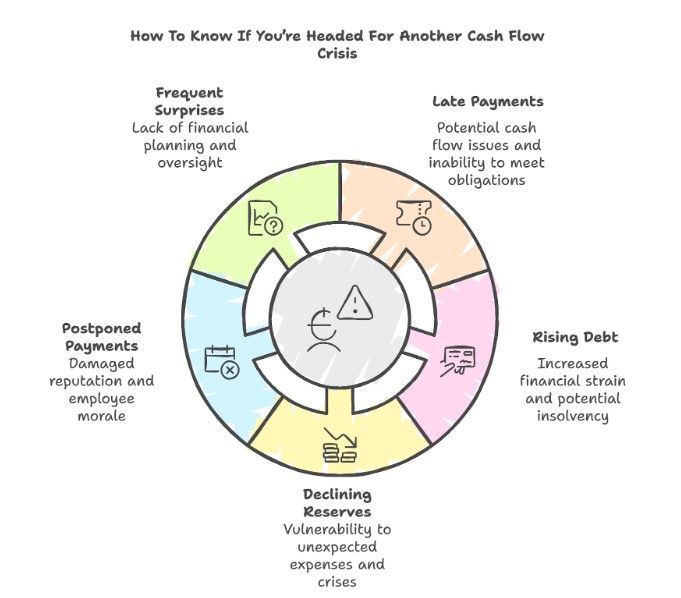

How To Know If You’re Headed For Another Cash Flow Crisis

Spotting early warning signs helps you respond before a cash flow crisis hurts your New Jersey business.

Proactive reviews and being alert to common red flags improve your financial stability, even during tough times.

5 Red Flags To Watch

- Late Payments from Customers

When invoices are paid late, your business may soon struggle to meet its financial obligations. Keep a close eye on accounts receivable aging reports. - Rising Short-Term Debt

If you’re borrowing more (often using credit cards or lines of credit) just to cover regular expenses, this is an urgent sign you need to examine your cash flow. - Declining Cash Reserves

Shrinking bank balances make it easy to get caught off guard by unexpected expenses. If the cushion is dropping month after month, address it before it becomes a crisis. - Postponing Payments or Payroll

Delaying vendor payments or payroll is a severe indicator of a looming problem. This can harm your business reputation and employee morale. - Frequent “Surprises” in Expenses

Unexpected costs, such as last-minute tax bills or repairs, can quickly deplete funds. If this happens often, there is likely a lack of financial planning or oversight.

Set Up A Quarterly Financial Health Review

Regular reviews make it easier to identify and address minor problems before they escalate into more significant issues.

Schedule a quarterly review of your income statements, balance sheets, and cash flow statements.

Use these meetings to compare actual results against your forecasts.

Review both profits and expenses, with a focus on trends that show increasing costs or slowing sales.

Involve your accountant or bookkeeper.

If finances are becoming increasingly complex, a part-time or fractional CFO can help establish more effective cash flow controls and reporting.

Consider using financial health review checklists and planning tools to structure your approach.

A quarterly review helps your business stay ready for changes in the economy, your industry, or even seasonal shifts in New Jersey.

It also ensures you have time to adjust your plans before problems happen.

Conclusion

Keep your priorities clear. Regularly monitor your income and expenses so you can respond quickly to any changes.

Updating your cash flow forecast for at least the next six weeks is critical. This gives you the insight to spot problems early and plan solutions.

Review all expenses. Eliminate unnecessary costs to keep your company running smoothly.

Pay close attention to every dollar leaving your business. Even small savings can add up during times of financial strain.

Use the advice from experts. Create a disaster recovery plan before a crisis gets worse.

Stabilized your cash flow? Make sure you’re ready for what’s next. Schedule a Growth Readiness Review with Coastal Business Services to stay on track. Book your session today.

If you’re ready to get started, call us now!

Frequently Asked Questions

What is a 30-day cash flow recovery plan?

It’s a structured approach to stabilize a business’s finances by controlling spending, improving collections, and forecasting weekly cash flow over 30 days.

How can I quickly resolve a cash flow crisis?

Cut non-essential expenses, collect overdue payments, negotiate vendor terms, and build a 6-week forecast to monitor and manage inflows and outflows.

What are the common signs of a cash flow crisis?

Frequent late payments, overdrawn accounts, missed payroll, and constant use of credit lines signal a serious cash flow issue.

Can a fractional CFO help solve cash flow problems?

Yes. A fractional CFO builds cash flow forecasts, guides short-term fixes, and implements systems to avoid recurring issues—all without full-time cost.

What’s the difference between cash flow and profit?

Profit is revenue minus expenses. Cash flow tracks real-time money in and out. A profitable business can still face a cash shortage.

Should I take out a loan during a cash flow emergency?

Only if paired with a recovery plan. A loan without structural changes may delay the problem, rather than solving it.

How can I prevent another cash flow crisis?

Set up rolling forecasts, monitor key performance indicators (KPIs) such as receivables turnover, and conduct quarterly financial health reviews with a service like Coastal Business Services.