Every business owner wants to know if their investment pays off, and this is especially true when it comes to hiring financial leaders.

A Fractional CFO can deliver top-level financial strategy and insight for a fraction of the cost of a full-time executive, giving companies a powerful return on investment.

Using a Fractional CFO ROI calculator helps organizations see exactly how the costs stack up against the real value created, from improved cash flow to better decision-making.

Many small and mid-sized businesses may not need a full-time CFO, yet still need expert financial leadership to face challenges and support growth.

Calculating the ROI of a fractional CFO reveals that companies often save on salary while still gaining the expertise needed to guide their future.

By understanding the numbers, business owners can feel more confident about where their money is going and what returns they can expect.

Key Takeaways

- ROI calculators show how fractional CFOs create value for businesses.

- Fractional CFOs provide financial expertise at significant cost savings.

- Companies can use data to determine if a fractional CFO is the right fit for their needs.

What Does A Fractional CFO Actually Do?

A fractional CFO offers high-level financial skills to businesses that do not need or cannot afford a full-time CFO.

They help improve the company’s financial health by offering expertise, guidance, and solutions for complex financial situations.

Strategic Financial Oversight Without Full-Time Cost

A fractional CFO provides advanced financial leadership on a part-time or contract basis.

This means businesses get executive-level insights at a fraction of the standard cost.

While a traditional in-house CFO can demand a six-figure salary, a fractional CFO is typically paid by the hour, by the day, or through a retainer.

Many small and mid-sized companies utilize fractional CFOs to develop long-term financial strategies, mitigate risks, and inform critical business decisions.

This includes assistance with fundraising, investor relations, or preparing for an audit or acquisition.

Unlike bookkeepers and controllers who focus on recording numbers and managing day-to-day transactions, a fractional CFO takes a big-picture approach.

They analyze data, forecast future challenges, and communicate directly with ownership or the board.

Services Typically Included In Fractional CFO Engagements

Fractional CFOs offer a broad set of services tailored to each business’s goals and needs.

Some of the most common services include:

- Preparing budgets and financial forecasts

- Improving cash flow management

- Setting up financial systems and software

- Advising on mergers, acquisitions, or fundraising

- Planning for sustainable growth or cost-cutting

- Helping with audit readiness and compliance

Companies can expect tailored advice to tackle unique financial challenges.

They may receive support during periods of rapid growth, change, or financial constraints.

A key benefit is receiving only the services needed, unlike a full-time CFO who performs broader, sometimes unnecessary functions for smaller businesses.

Curious if a fractional CFO is worth it? Coastal Business Services offers a Free Financial Health Assessment for NJ businesses. Contact us today to schedule your review.

If you’re ready to get started, call us now!

Measuring Value: What ROI Should You Expect?

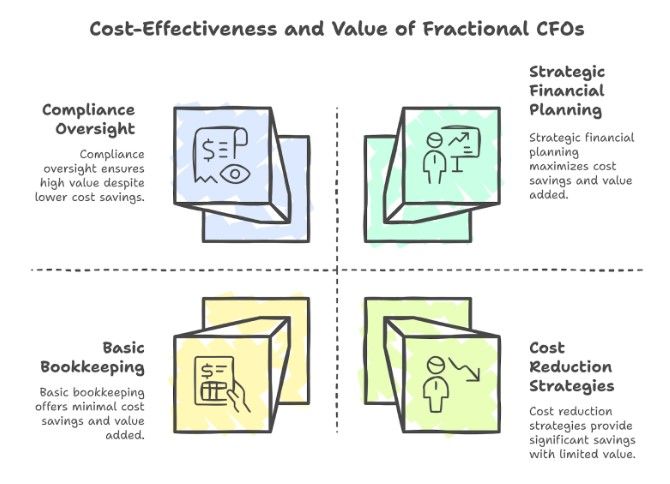

The ROI of a fractional CFO is often measured in clear financial returns, cost savings, and improved decision-making speed.

Key value drivers include increased profits, better forecasting, and efficient use of resources.

5 Key Value Drivers Of A Fractional CFO

Fractional CFOs help companies by improving cash flow, increasing profits, and providing accurate forecasts.

They often find ways to reduce expenses through careful vendor negotiations and spending reviews.

These professionals streamline financial operations, freeing up time for owners and managers to focus on other key tasks.

Hiring a fractional CFO delivers cost-benefit advantages over a full-time CFO.

While a full-time CFO may cost over $200,000 a year, a fractional option might range from $2,500 to $10,000 per month.

This allows companies to access high-level advice without the typical salary burden.

Key benefits include:

- Detailed budgeting and forecasting

- Improved cash management

- Support for fundraising or lending

- Increased business valuation

- Financial risk reduction

Case Studies & Financial Benchmarks

Many businesses report a positive return on investment within months after hiring a fractional CFO.

For example, one company maintained the same finance team size even as headcount grew, simply by tapping into the CFO’s financial forecasting expertise.

This allowed for growth without extra operational costs.

Financial benchmarks suggest that firms utilizing fractional CFOs may experience a 3-5% increase in net profit margin, resulting from improved financial planning and expense control.

The cost-benefit analysis often favors fractional services when businesses face seasonal or rapid shifts. Valuation increases are another benefit.

A CFO’s input on clean financials and strategic planning can raise a business’s value in the eyes of investors or buyers, supporting long-term growth.

Fractional CFO ROI Calculator: Estimate Your Gains

Understanding the real cost versus value of a fractional CFO can guide better decisions.

By focusing on the right inputs and reviewing a sample calculation, business owners can see how fractional CFO services impact the bottom line.

Inputs To Include In An ROI Model

Key inputs for a fractional CFO ROI calculator include company size, annual revenue, financial challenges, and the expected number of hours or days a CFO will serve.

It’s essential to include the cost of a fractional CFO, which typically ranges from $2,500 to $10,000 per month for many small businesses, depending on their needs and complexity.

Businesses should also estimate the value created by a part-time Chief Financial Officer (CFO).

Key value drivers include cost savings, improved cash flow, faster reporting, and enhanced strategic planning.

Some models utilize lists or tables to facilitate cost comparisons and predicted savings.

The more detailed the input, the more accurate the ROI estimate will be.

Sample ROI Calculation Walkthrough

To demonstrate, consider a company earning $6 million yearly that hires a part-time CFO for $5,000 per month.

Management expects reduced costs, improved cash management, and annual revenue growth of $120,000.

A sample table for this scenario might look like:

| Item | Annual Value |

| CFO Cost | $60,000 |

| Savings + Growth | $120,000 |

| Net Gain | $60,000 |

| ROI | 100% |

This calculation helps businesses clearly understand the value a part-time CFO brings to their cost.

Tools like a part-time CFO ROI calculator aid in this process, helping to estimate gains accurately.

Struggling with unpredictable expenses or tight margins? Coastal Business Services provides detailed Cash Flow Analysis to uncover risks and free up working capital. Reach out for your assessment now.

If you’re ready to get started, call us now!

How Fractional CFOs Save You More Than They Cost

Fractional CFOs can deliver significant value to small and medium-sized businesses by lowering overhead costs while improving financial results.

These financial leaders provide targeted expertise at a fraction of the cost of a full-time executive, making their services both affordable and cost-effective.

Time Value: Freeing Up The Business Owner

Fractional CFOs help business owners focus on running and scaling their companies instead of handling complex financial tasks.

By outsourcing strategic planning, cash flow management, and financial reporting, owners gain back valuable hours each week.

Owners often struggle to juggle multiple roles.

A fractional CFO assumes time-consuming responsibilities, such as preparing budgets, managing audits, and overseeing compliance.

This arrangement allows business leaders to focus on sales, operations, and client service.

Studies show that regaining just 10 to 15 hours a month can have a significant impact on owner productivity and stress, ultimately helping the company grow more quickly.

Fractional CFO pricing is typically based on the number of hours worked or a fixed monthly fee, rather than a full-time salary.

This flexible approach saves up to 60% compared to hiring a traditional CFO, as noted by Profit Leap.

For small and mid-sized companies, the time savings often represent one of the clearest examples of actual return on investment (ROI).

Avoiding Costly Mistakes

Fractional CFOs shield small business owners from expensive pitfalls. Their expertise enables them to spot errors before they become costly, such as tax oversights, missed payments, or inadequate cash flow planning.

Mistakes in financial management can result in thousands of dollars in penalties, interest charges, or lost profits.

These professionals make sure accounting records are accurate, policies are followed, and compliance deadlines are met.

They also help owners make informed decisions about loans, investments, and large purchases.

Without guidance, businesses may overextend financially or sign risky contracts.

Cost savings isn’t only about payroll. It’s about the money not lost due to mismanagement.

A fractional CFO can save more than 60% compared to a full-time CFO, while adding value by preventing financial errors.

This makes them a cost-effective choice for growing companies seeking reliable financial leadership.

Is It Time To Hire A Fractional CFO For Your Business?

Companies may reach a point when basic accounting is no longer enough.

Bringing in a fractional CFO can address growing complexity, support new financial goals, and provide expert guidance at a lower cost than hiring a full-time CFO.

Key Triggers That Justify The Investment

Businesses often require a CFO when they begin to scale, raise outside funding, or experience rapid growth.

When cash flow becomes more complex to manage or detailed forecasts are required, a fractional CFO can deliver part-time expertise while helping to establish stronger processes.

Indicators include unclear financial reports, missed budget targets, or confusion over pricing and margins.

If leaders are spending too much time on financials instead of focusing on growth, or investors require professional reports, these are clear signs to consider taking this step.

Companies lacking an in-house financial strategy also benefit from external support, especially when planning for expansion or mergers.

A fractional CFO also guides businesses during changing market conditions or when applying for loans and new investments.

They can help businesses raise the right amount of funds at the right time. This improves decision-making and long-term stability, as explained in this Forbes analysis.

Coastal Business Services’ CFO Support Options

Coastal Business Services offers multiple CFO support options tailored to fit business needs and growth stages. Services include financial strategy, cash flow management, KPI tracking, and budgeting at flexible levels—ideal for small and mid-sized companies.

Clients can choose part-time CFOs for advisory roles or more hands-on management of daily financial operations.

Packages may be customized, with hourly or monthly pricing based on business size and complexity, making expert support more accessible.

A team of professionals extends beyond a single CFO, providing bookkeeping, controller, and finance support as needs change.

This flexibility ensures that as a business grows or faces new financial challenges, the right level of support is always available.

It is designed for companies that want expert financial leadership without the overhead of a full-time hire.

Conclusion

A fractional CFO can offer companies high-level financial expertise without the full-time costs associated with a traditional CFO.

Businesses often pay between $3,000 and $10,000 per month, compared to over $200,000 per year for a full-time Chief Financial Officer (CFO).

This can significantly lower annual expenses while still giving access to important financial guidance.

Small businesses may not need a full-time CFO until they reach approximately $25 million in annual revenue.

Until then, a fractional CFO can provide needed support for a fraction of the price.

For business owners, tools like a fractional CFO ROI calculator can help estimate savings and measure added value.

This flexible approach enables companies to tailor their financial leadership to their specific needs and budget.

Is your $2M+ business ready to scale? A Growth Readiness Review from Coastal Business Services shows you how to move forward with confidence. Schedule your session today.

If you’re ready to get started, call us now!

Frequently Asked Questions

How do you calculate the ROI of a fractional CFO?

To calculate ROI, subtract the cost of the CFO from the financial improvements they deliver, then divide that by the price. ROI = (Gain – Cost) / Cost.

What’s a typical return on investment for a fractional CFO?

Many small to mid-sized businesses achieve a 2- to 5-fold return on investment (ROI) from fractional CFO services, driven by increased revenue, reduced expenses, and more effective financial planning.

How much does a fractional CFO cost per month?

Fractional CFOs typically cost $3,000 to $10,000 per month, depending on the scope of services and business complexity. Coastal Business Services offers flexible pricing.

Are fractional CFOs cost-effective for $2M revenue businesses?

Yes. Businesses generating $ 2 million or more in annual revenue often lack an internal financial strategy. A fractional CFO fills that gap, helping improve margins and avoid costly mistakes.

What should I include in a CFO ROI calculator?

Key inputs include CFO cost, baseline revenue, projected revenue growth, expense reduction estimates, and time savings. Coastal Business Services can help model this accurately.

How long before I see ROI from a part-time CFO?

Most businesses start seeing a return on investment (ROI) in 3–6 months, especially when addressing major issues such as cash flow gaps or unoptimized pricing models.

What’s the value of using a fractional CFO vs. a bookkeeper?

A bookkeeper tracks transactions; a fractional CFO provides strategic planning, forecasting, and decision support, delivering financial leadership that drives measurable results.