Marriage after decades together can hit a crossroads. Some couples decide it’s time to end things.

Grey divorce refers to the legal separation of couples aged 50 and above. This trend just keeps growing in New Jersey and across the country.

The numbers really jump out. Over 520,000 Americans aged 55 and older divorced in 2023, accounting for more than 40% of all divorces.

That’s double what it was just a decade ago. Most of these couples have been married for sixteen years or longer.

Couples thinking about divorce after 50 face distinct challenges compared to younger folks.

The law gets complicated fast—retirement accounts, shared assets, and family dynamics all require careful handling under New Jersey law.

Key Takeaways

- Grey divorce cases in New Jersey often involve unique legal and financial issues, including the division of retirement accounts, long-term alimony, and changes to health insurance.

- Preparation is critical—gather financial records, consult a divorce attorney familiar with late-life cases, and review estate planning documents early in the process.

- Emotional and family impacts should not be overlooked, even when children are grown, as relationship dynamics and personal identity can shift significantly after divorce.

- Specialized financial guidance can protect your future, helping you navigate asset division, minimize tax consequences, and plan for life after 50 with greater stability.

What Is Grey Divorce? A Guide For Couples Over 50 In New Jersey

Grey divorce describes couples over 50 who end their marriages. This is a growing trend in New Jersey and the rest of the U.S.

The numbers paint a clear picture. The divorce rate for couples 50 and older has nearly doubled since the 1990s. For those over 65, it’s tripled.

Key Characteristics of Grey Divorce

| Factor | Description |

| Age Range | Typically, couples over 50 years old |

| Marriage Length | Often decades-long relationships |

| Children | Usually grown children or empty nesters |

| Assets | Complex financial situations with retirement accounts |

Couples in this age group face unique challenges compared to younger divorces. They often hold shared retirement accounts, real estate, and investments that require careful management.

Grey divorce in New Jersey brings specific legal considerations. Couples must sort out property division, alimony, and support, all while protecting their retirement.

Common reasons include empty nest syndrome, drifting apart, and shifting life priorities. Sometimes, people realize they only stayed together for the sake of the kids, and now they want something different.

Many over-50 couples prefer collaborative solutions over contentious court battles. Mediation can be a significantly less stressful experience for everyone involved during this major life change.

What Does “Grey Divorce” Mean For Couples In New Jersey?

Grey divorce refers to the divorce of couples aged 50 and older. This trend’s been on the rise, including right here in New Jersey.

Key Characteristics of Grey Divorce:

- Usually happens after long-term marriages (often 20+ years)

- Involves couples nearing or already in retirement

- Often brings complex financial considerations

- May involve adult children

Financial Implications in New Jersey

New Jersey employs equitable distribution in divorce cases. Courts divide marital assets fairly, which doesn’t always mean equally.

Fair property division in New Jersey can get complicated for older couples. Most have built up significant assets over many years together.

Common Assets to Divide:

- Retirement accounts (401k, IRA, pensions)

- Real estate

- Investment portfolios

- Business interests

- Social Security benefits

Unique Challenges for Older Couples

Grey divorce brings its own set of challenges. Older spouses often lack sufficient time to recover financially after splitting assets.

Primary Concerns Include:

- Retirement planning – splitting funds affects both futures

- Healthcare costs – losing a spouse’s insurance coverage

- Housing decisions – figuring out who keeps the home

- Income replacement – adjusting to living on one income

The emotional side’s different, too. Starting over later in life, sometimes with grandchildren or aging parents to consider, isn’t easy.

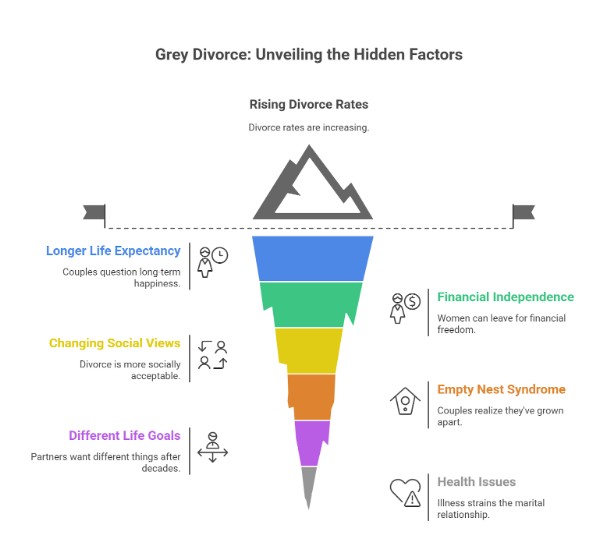

Why Is Grey Divorce On The Rise For NJ Couples Over 50?

Grey divorce rates have nearly doubled in the past decade. Over 520,000 Americans aged 55 and up divorced in 2023, making up more than 40% of all divorces.

So, what’s behind this trend in New Jersey?

Longer Life Expectancy

People live longer and healthier now. Couples realize they might spend another 20 or 30 years together. That can make them question whether they want to stay in an unhappy marriage.

Financial Independence

More women are pursuing careers and achieving absolute financial stability. They don’t have to stay married for money. That freedom makes leaving a bad relationship more possible.

Changing Social Views

Grey divorce is much more socially accepted now in New Jersey. The old stigma around divorcing later in life has faded.

Empty Nest Syndrome

Once the kids move out, some couples see they’ve grown apart. They might realize they no longer share much in common.

Different Life Goals

After decades together, people sometimes want different things. One partner wants to travel, the other wants to stay home. That can cause friction.

Health Issues

Serious illness can put a huge strain on a marriage. Caregiving and facing mortality can prompt people to reevaluate their relationships.

Coastal Business Services supports New Jersey couples over 50 with Divorce Mediation designed to reduce stress, protect finances, and create fair agreements. Contact us today to start planning your next chapter.

If you’re ready to get started, call us now!

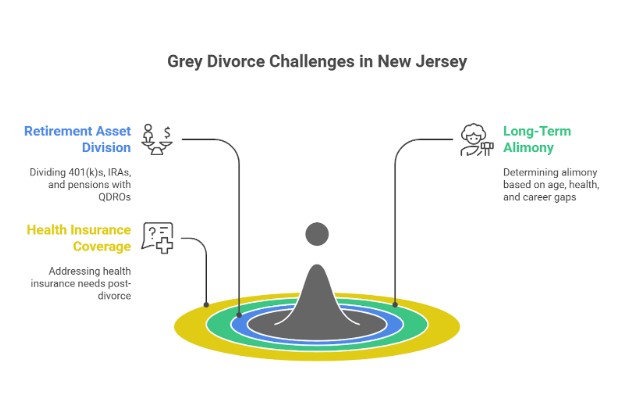

Unique Legal Challenges In Grey Divorce Under New Jersey Law

Grey divorce cases in New Jersey raise complex legal issues that are not typically present in younger divorces.

Dividing up retirement assets, figuring out spousal support for older spouses, and sorting out health insurance for people near or past retirement age—these are all huge pieces of the puzzle.

Division Of Retirement Accounts And Pensions

Protecting retirement assets is one of the biggest challenges in grey divorce. Couples who’ve been married for 20 years or more typically have multiple retirement accounts, pensions, and investments that require a careful review.

Dividing 401(k)s and IRAs means using Qualified Domestic Relations Orders (QDROs) to move money without tax penalties.

New Jersey courts determine the marital share of each account based on when contributions were made and the duration of the marriage.

Pensions add another layer of complexity. Many older spouses rely on these benefits for their retirement. The court has to decide whether to:

- Immediate offset: One spouse gets the pension, the other gets assets of equal value

- Deferred distribution: Both spouses get a share when the pension pays out

- Present value calculation: The court uses the pension’s current worth to split things up

Social Security matters also come into play. Courts can’t split Social Security directly, but they might adjust other assets based on what each spouse expects to get from Social Security.

Long-Term Alimony For Older Spouses

Divorce later in life brings up special alimony issues. New Jersey courts consider whether an older spouse can realistically earn enough, especially if age or health makes it challenging to work.

Permanent alimony is more common in grey divorce. Spouses over 50 often struggle to rebuild their careers or save enough before retirement.

The court considers several factors that hit older couples especially hard:

| Factor | Consideration |

| Age and Health | Can the spouse physically work and earn? |

| Career Gap Duration | Time out of the workforce hurts employability |

| Skill Obsolescence | Are their job skills still useful? |

| Retirement Timeline | How many years are left before retirement? |

Changing alimony gets tricky when the paying spouse retires. New Jersey law says you have to show a big change in circumstances before a judge will modify alimony payments.

Impact On Health Insurance Coverage

Health insurance coverage becomes a critical concern for divorcing spouses over 50. Many older folks rely on their spouse’s employer-provided health insurance and then face limited options after divorce.

COBRA continuation offers temporary coverage for up to 36 months after divorce. However, the divorced spouse pays the full premium plus administrative fees, which can become expensive quickly.

Pre-existing conditions complicate insurance shopping for older adults. If you have chronic health issues, you may encounter higher premiums or coverage limitations when shopping for your own policy.

The court may order the employed spouse to keep health insurance coverage if:

- The dependent spouse can’t get affordable coverage

- Alimony calculations include insurance premium costs

- The marriage lasted more than 20 years

Medicare eligibility matters for spouses nearing age 65. Courts must weigh whether the timing of a divorce affects Medicare benefits and supplemental insurance needs.

Medicaid planning may become necessary if health insurance costs consume a significant portion of someone’s limited retirement income after dividing assets.

How Grey Divorce Impacts Your Retirement And Finances

Grey divorce presents unique financial challenges that couples must navigate carefully. These divorces disrupt retirement plans that took decades to build.

Retirement Account Division

Dividing retirement accounts gets complicated during a grey divorce. Couples usually have several types of retirement savings, including:

- 401(k) plans

- Individual Retirement Accounts (IRAs)

- Pension benefits

- Investment portfolios

Each spouse may receive a portion of these accounts through a legal division order.

Income Changes

Individuals who are divorced often experience significant income reductions. They lose their spouse’s earnings and may have to pay or receive alimony, which can significantly alter their monthly budget.

Living Expenses Increase

Running two separate households costs more than sharing one. Former spouses now have to cover:

| Expense Type | Impact |

| Housing costs | Rent or mortgage payments double |

| Utilities | Separate bills for each household |

| Insurance | Individual health and auto coverage |

Social Security Benefits

Divorced spouses might qualify for benefits based on their former partner’s work record. The marriage must have lasted at least 10 years for this option.

Healthcare Coverage

Adjusting to new healthcare needs gets critical here. One spouse may lose employer-sponsored insurance and have to find individual coverage.

Facing asset division or retirement concerns in a grey divorce? Coastal Business Services offers clear financial guidance to help you move forward with confidence. Schedule your confidential consultation today.

If you’re ready to get started, call us now!

Emotional And Family Considerations In Divorce After 50

Ending a long marriage later in life brings unique emotional challenges. Couples grieve over lost dreams and the end of decades together.

Adult children often struggle with their parents’ divorce. They might feel caught in the middle or pressured to pick sides. Some even blame themselves for missing the warning signs.

Empty nest syndrome can exacerbate divorce emotions. Without daily parenting duties, couples sometimes realize they’ve grown apart.

Social circles often change a lot after a gray divorce. Married friends might feel awkward inviting divorced folks to couples’ events.

Key emotional impacts include:

- Loss of shared identity as a couple

- Fear about dating again after many years

- Anxiety about living alone

- Worry about burdening adult children

Grandchildren may feel the effects too. Custody arrangements can become complicated when grandparents separate.

Many people deal with depression and anxiety during this transition. Divorce may coincide with other significant life changes, such as retirement or health issues.

Financial stress adds to the emotional load. Financial worries can make grieving even more difficult.

Some folks feel relief after ending an unhappy marriage. They might look forward to rediscovering themselves and finding new interests.

Professional counseling helps people work through these tough emotions. Support groups for gray divorce situations offer valuable peer connections.

Preparing For A Grey Divorce In New Jersey — Step-By-Step

Grey divorce requires careful planning due to the complexities of finances and retirement concerns. Taking the right legal and financial steps early helps protect assets and keeps documentation on track.

1- Legal Consultation

Getting professional legal advice is the first big step in any grey divorce. Experienced divorce attorneys in New Jersey are familiar with the unique challenges that couples over 50 face.

An attorney can guide you through New Jersey’s property division laws. They explain how retirement accounts, pensions, and Social Security benefits get split. For many couples, these assets took decades to build.

Legal experts also cover spousal support. Alimony calculations shift when one spouse is near retirement age. Courts consider earning capacity and health status, among other factors.

Key attorney services include:

- Filing divorce paperwork

- Negotiating asset division

- Protecting retirement benefits

- Handling complex property issues

Getting help with the divorce filing process makes sure you don’t miss any legal requirements.

2- Financial Inventory & Valuation

Building a comprehensive financial picture is crucial before you move forward. Couples over 50 typically have more complex financial situations than younger individuals going through a divorce.

Start by gathering all financial documents from the past three years. That means bank statements, investment accounts, and retirement fund records. Property deeds and business ownership documents count too.

Essential financial documents:

- Tax returns (3-5 years)

- 401(k) and IRA statements

- Pension benefit summaries

- Real estate appraisals

- Business valuations

Professional appraisals for homes, businesses, or valuable collections may be needed. Many grey divorces involve significant assets that need expert valuation. Getting accurate numbers now helps avoid fights later.

It can be helpful to hire a financial planner who specializes in divorce. They can help you project your post-divorce needs and assist with retirement planning strategies.

3- Revising Wills And Beneficiaries

Estate planning documents need immediate attention during a grey divorce. Most couples already have wills, trusts, and beneficiary designations naming their spouse as the main recipient.

Update beneficiaries on all retirement accounts, life insurance policies, and investments to ensure accurate information is maintained. Otherwise, your soon-to-be ex might get benefits you meant for your kids or someone else.

Documents to update:

- Last will and testament

- Trust agreements

- Life insurance beneficiaries

- Retirement account beneficiaries

- Power of attorney designations

Create new estate planning documents before the divorce is final. This step protects your assets and makes sure your wishes are clear. It’s easy to overlook these changes when you’re stressed, but they’re essential.

Consider setting up separate trusts for your adult children or grandchildren. That move can add asset protection and tax benefits. Estate planning gets more complicated, but it’s also more crucial during a grey divorce.

Finding The Right Grey Divorce Attorney In New Jersey

Choosing the right attorney for a grey divorce takes some thought. Not every divorce lawyer has experience with the challenges older couples face.

Look for attorneys who focus on grey divorce cases in New Jersey. These lawyers are well-versed in handling complex financial issues, including retirement accounts and pensions.

Key Qualities to Seek:

- Experience with older clients – The attorney should regularly handle cases for couples over 50

- Financial expertise – They need to know retirement planning and asset division

- Patience and understanding – They should work well with clients facing major life changes

- Strong negotiation skills – Important for property and alimony talks

Consider whether mediation might be a better option than going to court. Some attorneys specialize in collaborative divorce to reduce stress and costs.

Questions to Ask Potential Attorneys:

| Question | Why It Matters |

| How many grey divorces have you handled? | Shows relevant experience |

| Do you work with financial planners? | Indicates a comprehensive approach |

| What is your fee structure? | Helps plan legal costs |

Set up consultations with a few attorneys before making a decision. This way, couples can compare styles and find someone they trust during a tough time.

The right lawyer will explain New Jersey’s laws clearly and help protect both parties’ financial futures.

Conclusion

Grey divorce affects thousands of New Jersey couples each year. The rising trend of gray divorce isn’t slowing down, and more people over 50 are looking for fresh starts.

New Jersey’s equitable distribution laws present unique challenges for older couples. Retirement accounts, pensions, and long-term assets need careful division.

Professional legal guidance often makes these choppy financial waters less intimidating. It’s not something you want to figure out alone.

Emotional preparation is just as necessary as financial planning. Many couples discover that ending a marriage after decades together brings an odd mix of loss and freedom.

Most grey divorce cases drag on longer than divorces among younger couples. The financial web just takes more time to untangle.

Support systems matter here. Counselors, financial advisors, and attorneys who’ve been through it all can make a world of difference.

Secure your future after divorce with Coastal Business Services—covering pensions, savings, and financial stability for life after 50. Contact us now to create your personalized post-divorce plan.

If you’re ready to get started, call us now!

Frequently Asked Questions

What is grey divorce in New Jersey?

Grey divorce refers to the legal separation or divorce of couples aged 50 and older in New Jersey. These cases often involve long marriages, significant assets, and unique issues like retirement division and long-term alimony.

Why are grey divorces increasing in New Jersey?

Grey divorce rates in NJ are rising due to longer life expectancies, shifting social norms, empty-nest transitions, and financial or lifestyle disagreements that become more pronounced later in life.

How does New Jersey handle retirement assets in a grey divorce?

New Jersey follows equitable distribution laws, meaning retirement accounts and pensions earned during the marriage are divided fairly, often using a Qualified Domestic Relations Order (QDRO) for proper transfer.

Can I receive alimony after a grey divorce in NJ?

Yes. In long-term marriages, NJ courts often award open durational or long-term alimony, especially when one spouse left the workforce to support the household.

Will my Social Security benefits change after a grey divorce?

Possibly. Suppose your marriage lasted at least 10 years. In that case, you may be eligible to claim benefits based on your ex-spouse’s work record without affecting their payments, provided you meet Social Security’s requirements.

What happens to health insurance after a grey divorce in NJ?

You typically lose access to your spouse’s employer-based plan after divorce. COBRA coverage, Medicare (if eligible), or Affordable Care Act marketplace plans are common alternatives.

How should I prepare for a grey divorce in New Jersey?

Gather financial documents, meet with a divorce attorney experienced in late-life cases, evaluate retirement accounts, and update estate planning documents to reflect your new circumstances.