Growing your business takes more than just strong ideas and hard work. As your company prepares to scale, one of the biggest challenges you face is finding the right funding to support the next stage.

Fractional CFOs play a key role by helping you unlock access to capital that matches your unique needs and timing.

A fractional CFO brings expertise in both finance and strategy. With their support, you can build financial systems that attract investors and lenders, prepare clear forecasts, and present your vision to potential capital partners.

This strategic guidance gives you a practical advantage in today’s competitive landscape, allowing you to confidently focus on growth.

Key Takeaways

- Funding growth requires careful financial planning, not just ambition.

- A fractional CFO connects your business to more funding options.

- Choosing an experienced CFO partner helps you navigate capital markets effectively.

Why Funding Growth Is Harder Than It Looks

Getting the capital you need for growth often takes more than just a good idea and a pitch deck. Business owners face tough hurdles, from complex paperwork to the need for experienced financial leadership and changing investor demands.

The Real Challenges Of Raising Capital

Many businesses underestimate the complexity behind capital raising. Documents must be accurate, forecasts realistic, and growth plans clear. Lenders and investors expect thorough financial records, up-to-date statements, and a strong explanation of how you will use the funding.

Mistakes or missing information slow down the process or even stop deals from going forward.

This is where a fractional CFO for raising capital can make a difference. A fractional CFO gives you access to senior financial expertise without the cost of a full-time hire.

They help ensure your business growth, your financial strategy is solid, and your pitch stands out.

Key challenges include:

- Building detailed financial models

- Managing due diligence requests

- Meeting strict reporting standards

Expert CFO support for funding rounds also helps avoid costly mistakes and increases your credibility with investors.

Investor Expectations Have Evolved

Today’s investors do not look only at products or market opportunities. They want to see structured financial plans, proven revenue streams, and realistic projections.

You are expected to answer difficult questions and show that you understand your financials inside and out.

Investors often ask for details about your unit economics, customer acquisition costs, and burn rate. They compare your business to others in the industry and look for signs you can scale.

Having a fractional CFO offers benefits for funding because they know what investors want. They help you prepare reliable data and explain your numbers simply.

Their experience increases your credibility and can be the edge you need in a competitive market.

Need funding to grow? Coastal Business Services offers fractional CFO support that gets results. Schedule a free strategy call and make your financials capital-ready—fast.

If you’re ready to get started, call us now!

What Fractional CFOs Bring To The Capital Table

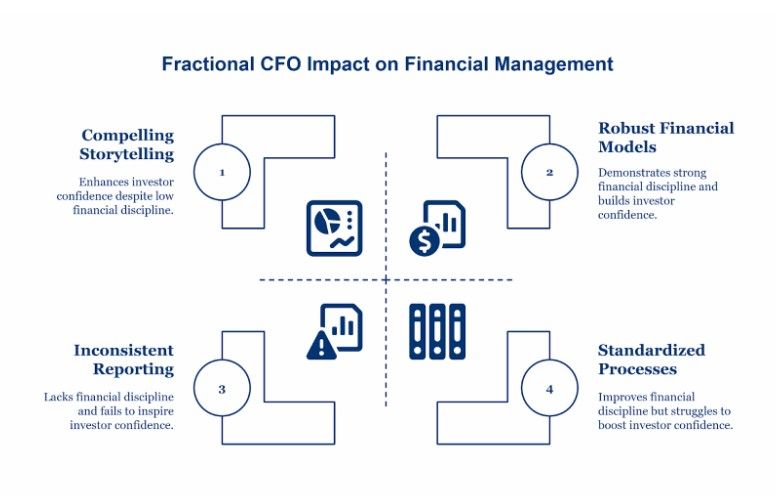

Getting capital often depends on communicating your numbers and demonstrating financial discipline.

Fractional CFOs use accurate reporting and smart storytelling to help your business stand out to banks and investors.

Professionalized Financial Reporting & Projections

A fractional CFO brings experience in putting together clear, accurate financial reports. This goes beyond bookkeeping. You get financial statements and dashboards that show real trends.

They can set up monthly closing processes and create custom reports so that your data is always up to date and audit-ready.

This lets you show exactly where your business stands and how your financial metrics support your requests for funding.

They also build robust financial models that reflect your growth strategy. You’ll have detailed cash flow projections and forecast scenarios, which help you answer tough investor questions.

The right numbers can show potential lenders and investors that your business is prepared and well-managed.

Storytelling With Numbers: Building Investor Confidence

Investors want more than spreadsheets—they want to understand your vision and see how the numbers back it up.

Fractional CFOs translate your company’s story into financial terms, making your growth plans easy to follow.

A fractional CFO helps you show why your business is ready for investment through clear charts, the use of key performance indicators (KPIs), and simple breakdowns.

They connect the dots between strategy and outcomes, highlighting past wins and future potential using detailed financial modeling.

When your business plan and forecasts align with your narrative, investors can see your company’s potential more easily. This builds trust and helps you stand out in a crowded fundraising field.

Financial Hygiene That Wins Bank & Investor Trust

Good financial hygiene means your books are organized, your numbers add up, and every claim you make is backed by data.

Fractional CFOs enforce strong internal controls, review your records for accuracy, and ensure policy compliance.

This level of discipline can make the difference when applying for a bank loan or approaching investors. Lenders and PE firms want to see not just ideas but signs of responsible financial management.

Fractional CFOs help you avoid common pitfalls like inconsistent reports, missing documentation, or unclear accounting.

By standardizing and improving your financial processes, you can easily pass due diligence and gain access to capital.

Types Of Capital A Fractional CFO Can Help You Secure

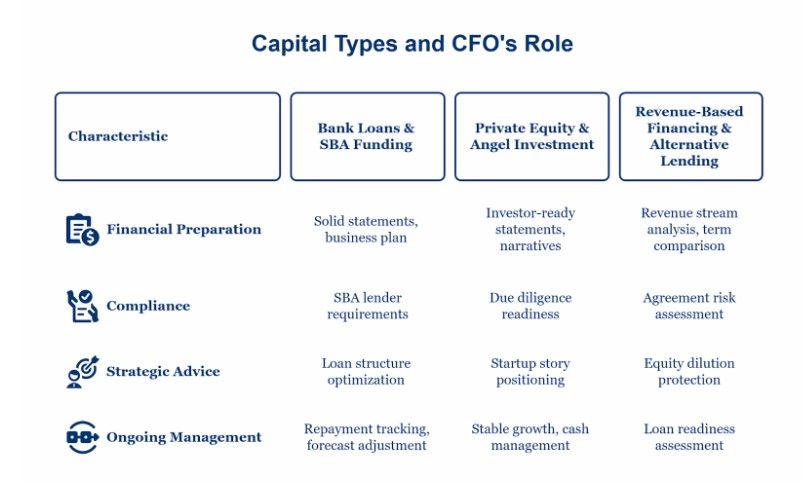

Securing the right type of capital is crucial when planning for growth. Different funding options offer unique advantages and require specific preparation, especially when working with lenders or investors.

Bank Loans & SBA Funding

A fractional CFO helps you prepare for traditional loans, including those backed by the Small Business Administration (SBA). You need solid financial statements, a clear business plan, and a strong credit profile.

Your CFO can assess your small business’s loan readiness by reviewing your numbers, identifying risk areas, and correcting gaps in your documentation. They can also assist you in putting together everything from profit and loss statements to cash flow projections, making your application more likely to succeed.

When seeking SBA loan help for a small business, your CFO ensures compliance with lender requirements.

They also advise on loan structures that match your needs without hurting your cash flow. Their expertise can speed up approval times and improve loan terms.

Private Equity & Angel Investment

Private equity firms and angel investors expect clear, detailed, and accurate financial reporting before investing in your company.

A fractional CFO can build investor-ready financial statements and polish your financial narratives.

When preparing your private equity pitch financials, your CFO helps you highlight stable growth, smart cash management, and opportunities for return on investment. They also ensure that you can respond confidently during due diligence.

If your goal is to attract angel investors, your CFO should position your startup story and metrics in a way that stands out.

They should clarify how new capital will be used and why your business is a good investment. This preparation helps increase trust with possible investors.

Revenue-Based Financing & Alternative Lending

Not all funding requires giving up equity. Revenue-based financing and alternative lending give you capital based on your sales or receivables, not just assets.

A fractional CFO can guide you on how to raise capital without equity dilution, protecting your control of the company.

Your CFO studies your revenue streams and matches you with funders whose terms fit your growth plan. They review offers side-by-side, putting the most important terms into a clear table for you to compare.

Your CFO manages your small business funding strategy, ensuring you aren’t trapped in expensive or risky agreements.

They help track your repayments and adjust forecasts, so you keep cash moving and avoid surprises.

Securing SBA or investor funding? Coastal Business Services builds bank-ready financials that lenders trust. Contact us today and let’s prepare your business for smarter growth.

If you’re ready to get started, call us now!

Choosing A CFO Partner That Understands Capital Markets

Selecting the right fractional CFO can make a difference in approaching capital, from finding the right funding options to getting your company ready for investors.

The right partner will help you balance business growth with careful capital structure planning and the right financial strategy.

What To Look For In A Fractional CFO

When considering a fractional CFO, look for someone with real experience in capital markets. Check that they have helped companies secure funding, such as venture capital, private equity, or bank loans.

A strong candidate will have a track record of structuring debt and equity deals that match your company’s growth stage.

They should also be aware of modern funding methods, like revenue-based financing strategies, which can offer alternatives to traditional loans and equity.

Ask about specific companies they have helped through successful fundraising rounds.

See if they understand industry benchmarks and can explain how your business compares to similar companies. Questions to ask may include:

- How do they evaluate a company’s readiness for funding?

- What connections do they have with investors or lenders?

- Can they outline their process for negotiating terms and due diligence?

Having someone with these skills gives you a trusted partner with a CFO when navigating the complex world of business funding.

You want someone who doesn’t just know the numbers—they must also understand market trends and speak the language of investors.

Aligning Capital Strategy With Business Vision

Your CFO partner should work to connect your funding plan to your long-term vision. This means planning a capital structure that matches your goals for growth, risk tolerance, and control of the business.

A knowledgeable CFO will help map out how much funding you need and the best way to get it. They should create clear financial forecasts, so investors can see the strength of your business model.

The advisor should be able to recommend when to use equity, debt, or new financing types based on your needs.

It’s important that your CFO considers both your short-term cash flow and big-picture targets. They must adapt strategies as markets, customer demand, or objectives change.

The right partner will communicate risks and opportunities, making sure your capital choices always help your business move forward. Read about how growing brands have used this approach to navigate financial challenges.

Conclusion

When you want to raise capital and grow your business, having a partner who understands finance can make a measurable difference.

A fractional CFO fills this role by using their expertise to help you prepare for new opportunities.

With a fractional CFO, you gain access to strategic skills without the cost of a full-time executive.

You get advice on planning, forecasting, and investor relations tailored to your business’s needs. This gives you the right tools to move forward confidently.

Here’s how a fractional CFO can support your journey:

| Benefit | What It Means for You |

| Financial forecasting | Know how much capital you need and when |

| Investor readiness | Get your financials organized for investors |

| Flexible expertise | Scale up or down based on your current needs |

Your financial partner helps open doors to capital by making your business more attractive to investors. This puts you in a stronger position, whether you are preparing to scale or enter a new market.

Don’t let missed opportunities hold you back. Schedule your free capital planning consultation with Coastal Business Services and start opening doors to the funding your business deserves.

Contact Us Today For An Appointment

Frequently Asked Questions

What is a fractional CFO, and how do they help with funding?

A fractional CFO offers part-time financial leadership, helping businesses create investor-ready reports, build forecasts, and secure funding without hiring a full-time executive.

How do I prepare my business to raise capital?

To raise capital, prepare audited financials, realistic projections, a clean cap table, and a clear growth story. A fractional CFO ensures all these elements align.

What funding options can a CFO help me access?

By aligning your financials with lender or investor expectations, a fractional CFO can help you access SBA loans, bank credit lines, angel investments, venture capital, and revenue-based financing.

Why do most small business loan applications get rejected?

Most loan applications fail due to inaccurate or incomplete financial documentation, poor cash flow visibility, and lack of strategic planning—issues a CFO can resolve.

What financial documents do investors want to see?

Investors typically ask for a balance sheet, income statement, cash flow projections, cap table, burn rate, and performance KPIs—all prepared accurately by a fractional CFO.

Is hiring a fractional CFO worth it for a small business?

Yes. Hiring a fractional CFO gives small businesses access to strategic capital planning, financial modeling, and investor presentation skills at a fraction of the full-time cost.

How can Coastal Business Services support my funding efforts?

Coastal Business Services provides fractional CFO services that help clean up your financials, build funding strategies, and prepare you for SBA, bank, or investor capital.