Divorce throws some real curveballs at New Jersey families trying to figure out college financial aid.

The FAFSA now only considers the parent who provided the most financial support over the past year, not the one with custody.

In contrast, the CSS Profile may request information from both parents, depending on the college.

This change from past rules can significantly impact aid eligibility, so families need to plan carefully.

Lots of divorced parents think the custodial parent always handles financial aid forms, but recent FAFSA changes flipped that script. Now, the parent who pays more takes charge, which can totally change a student’s expected family contribution and their aid package.

Understanding these rules is crucial when thousands of dollars are at stake. New Jersey families have to juggle both federal requirements and state-specific programs, and it’s surprisingly easy to make mistakes that shrink your financial aid eligibility.

Key Takeaways

- FAFSA now uses the parent who provides the most financial support, not just the custodial parent, for divorced families.

- CSS Profile schools may request financial information from both divorced parents, which could reduce aid eligibility.

- New Jersey families should coordinate federal aid rules with state grant programs and consider timing strategies for optimal results.

Why Divorce Complicates College Financial Aid in NJ

Divorce affects college financial aid because the FAFSA now counts the income of the parent who actually pays the most, not just the one with custody.

New Jersey adds another layer with state grants that might ask for different parent information than the federal forms.

FAFSA Simplification Changes: Support-Based Parent

The FAFSA updates now focus on which parent provided more support, not which one has legal custody. If you paid more in the last year, you’re the one who fills out the FAFSA.

This can definitely throw some parents off. Legal custody doesn’t matter anymore; it’s all about the actual dollars spent.

Key factors for figuring out the contributor parent:

- Housing costs covered

- Food and living expenses paid

- Healthcare premiums and medical bills

- School fees and extracurriculars

- Transportation costs

Parents need to keep good records of these expenses. The individual who pays more submits their tax and income information on the FAFSA.

If both parents provide exactly the same support, the parent with the higher income must fill out the FAFSA. That can significantly impact aid, as income and assets play a substantial role in the calculations.

NJ’s Extra Step: NJFAMS for State Grants

New Jersey adds another requirement: families must use NJFAMS for state grants, and this system may request different parent information than the FAFSA. It’s more paperwork, for sure.

NJFAMS has its own rules for divorced parents. Sometimes, both parents have to provide info, which isn’t how the FAFSA works.

NJFAMS headaches can include:

- Different income reporting rules

- Deadlines that don’t match FAFSA’s

- Extra paperwork

- Possible conflicts about which parent’s info to use

New Jersey courts can even require divorced parents to contribute to their children’s college expenses. But what the court wants and what the financial aid office counts don’t always match up.

The state application just adds another layer. You really have to keep track of both federal and state requirements—sometimes they don’t line up at all.

Coastal Business Services guides NJ families through FAFSA, CSS, and NJFAMS amidst divorce—get clarity on your next move. Contact Us.

If you’re ready to get started, call us now!

FAFSA Rules for Divorced or Separated Parents

The FAFSA has specific rules about whose finances count. Only one parent usually fills it out—the one who paid the most support in the past year.

Custodial Parent Definition in FAFSA (Support Test)

The FAFSA for divorced parents uses a “support test” to figure out the custodial parent. That’s just the parent who paid more than half of the student’s expenses in the last 12 months.

Support encompasses housing, food, clothing, medical care, and other essentials. The person who covers most of these expenses is considered the custodial parent for FAFSA purposes, even if the student lives with the other parent.

Legal custody doesn’t matter here. A kid might live with one parent, but if the other pays more, that’s the parent who files the FAFSA.

Both parents must determine exactly what they spent on the student. This includes direct payments and any expenses they paid on behalf of the student.

The custodial parent’s income and assets go straight into the Student Aid Index (SAI). If that parent makes less, the student usually qualifies for more aid.

Tie-Breaker Rule: Parent With Higher Income

If both parents provide exactly the same support, FAFSA uses a tie-breaker: the higher-income parent must file. That’s usually not great for financial aid, but it’s the rule.

This only applies if the support is truly equal, so parents need to maintain accurate records. If you’re in a tie, be ready to show documentation.

The higher earner fills out the FAFSA when it’s a tie. That often means less aid, since a higher income bumps up the SAI.

These new FAFSA rules make careful tracking of expenses even more important. Don’t just guess—keep receipts and statements if you want to make your case.

Child Support Received = Asset (New Change)

Now, child support received by the custodial parent counts as an asset on the FAFSA. That’s a big shift from past years.

The custodial parent has to list all child support payments as untaxed income, including any back payments. That can add up fast.

Child support bumps up the family’s available resources for college. More assets usually mean a higher SAI and less aid.

Parents need to report the full amount received during the relevant tax year. Even small monthly payments stack up over twelve months.

This change means divorced parents should rethink how they approach the FAFSA. Child support now counts against you, so don’t overlook it.

CSS Profile Requirements for Divorced Families

The CSS Profile typically requests financial information from both parents if your college uses this application, regardless of whether you are divorced.

Unlike the FAFSA, which only considers one parent, the CSS Profile requires a comprehensive family financial picture.

Why CSS Is Stricter Than FAFSA

The CSS Profile is more stringent for divorced families. It wants both parents’ financial info, not just the one who pays more.

Most CSS Profile schools require the non-custodial parent to complete their own section. That means more paperwork and, sometimes, more headaches.

Key differences:

- FAFSA only needs custodial parent info

- CSS Profile asks for both parents’ financial details

- The noncustodial parent must turn in tax returns and bank statements

- Both parents’ new spouses might get pulled in, too

Approximately 400 colleges and scholarship programs utilize the CSS Profile for their own financial aid purposes. They want to see the big picture before handing out money.

Things become complicated if one parent refuses to cooperate. Some parents only find out about this requirement after their kid’s already applied.

When Waivers for the Noncustodial Parent May Be Allowed

Sometimes, colleges will grant waivers if the noncustodial parent can’t or won’t fill out their section. You’ll need to provide documentation, though—it’s not automatic.

Common reasons for waivers:

- Domestic violence or abuse: If there’s been danger to the parent or child

- Abandonment: No contact or support for a long time

- Incarceration: Noncustodial parent is in prison

- Unknown whereabouts: Can’t find the parent, even after trying

Each college sets its own rules for waivers. You need to contact the financial aid office and ask.

They might want police reports, court records, or letters from counselors. Getting a waiver can take a few weeks, so don’t wait until the last minute.

Some schools are more flexible than others. Private colleges might be more lenient about waivers than public ones, but it really depends.

NJ-Specific Financial Aid Steps (NJFAMS & TAG Grants)

New Jersey families must handle both the federal FAFSA and the state’s NJFAMS system to receive grants like TAG.

The New Jersey Financial Aid Management System operates independently to manage all state aid, separate from the federal side.

Deadlines and Login Process

Students in New Jersey need to set up NJFAMS accounts by the right deadlines to get state aid. The NJFAMS portal is open for 2025-2026 applications.

Key NJFAMS steps:

- Finish the FAFSA first before starting NJFAMS

- Set up an NJFAMS account at HESAA.org

- Submit New Jersey residency proof

- Try to meet the October 1st priority deadline for the most aid

The login process asks students to confirm their New Jersey residency. They’ll need documents such as utility bills, tax returns, or lease agreements to demonstrate continuous residency in NJ.

State aid programs operate independently of the federal FAFSA. Students get different award letters for state and federal aid.

Example: TAG Verification and Household Size Checks

TAG grant verification checks income limits and enrollment status at approved New Jersey schools. The Tuition Aid Grant helps cover tuition for about a third of full-time undergrads in New Jersey.

Common Verification Steps:

- Send tax transcripts that match FAFSA data.

- Show proof of full-time enrollment at an NJ college.

- Verify household size with dependency documents.

- Provide marriage or divorce papers if parents are divorced.

Divorced families deal with extra scrutiny during TAG checks. HESAA considers both custodial and non-custodial parent information to determine household size.

Income limits for TAG change every year. Students must reapply annually and maintain satisfactory academic progress to remain eligible.

How Remarriage Affects FAFSA & CSS

When a custodial parent remarries, the new spouse’s income and assets count on the FAFSA. This can significantly impact aid eligibility.

Blended families often get less financial aid because the parents’ and stepparents’ incomes are combined.

Effect on Aid Eligibility With Examples

The stepparent’s financial information is added to the student’s aid calculation as soon as the marriage occurs. Even if the stepparent isn’t paying for college, their financial situation still matters.

Example scenarios show the impact:

- A single parent earning $40,000 may be eligible for the maximum Pell Grant.

- If that parent marries someone earning $60,000, the situation changes.

- The new $100,000 combined income threshold can eliminate Pell Grant eligibility.

The CSS Profile works a lot like this, too. Private colleges that use the CSS Profile will request financial information from stepparents.

Timing considerations matter for blended families:

- Some parents wait to remarry until after FAFSA filing.

- The wedding date can affect aid eligibility for the whole academic year.

- Getting married in December can impact next year’s aid application.

If the stepparent has children, those children also count in the household size. That can help by bumping up the family member count.

Stay on track with your aid application—Coastal Business Services helps you avoid mistakes and meet deadlines. Schedule your consultation today.

If you’re ready to get started, call us now!

Timing Matters — Divorce, Prior-Prior Year Data & Appeals

The FAFSA uses tax data from two years before the award year. That gets tricky if parents divorce after those taxes are filed. Recent divorces need special handling through professional judgment at each college.

Appeal Scenarios: Custody Shifts, Sudden Job Loss, Remarriage

Recent Divorce After Tax Filing

Parents who divorce in 2024 but file their 2023 taxes together encounter a mismatch. The FAFSA shows both incomes, but now only one parent supports the student.

Families need to file the FAFSA with their joint tax information first. Then, they should contact each college’s financial aid office immediately to request a Professional Judgment Review.

Custody Changes Mid-Year

If custody changes during the academic year, the aid picture flips. The new custodial parent’s income is now used in aid calculations.

Students should let colleges know as soon as custody changes. Some schools adjust aid mid-year, but others wait until the next year.

Job Loss or Income Changes

If the custodial parent loses a job, the family’s ability to pay takes a hit. FAFSA data might still show a high income that doesn’t exist anymore.

Financial aid offices can change aid packages if they get proof of job loss. Parents should send in termination letters, unemployment statements, and bank statements.

Remarriage Complications

When the custodial parent remarries, the stepparent’s income goes on the FAFSA. This can seriously shrink aid eligibility.

The timing of remarriage really matters. Families should plan two years in advance for the FAFSA because the prior-prior year rule can trip people up.

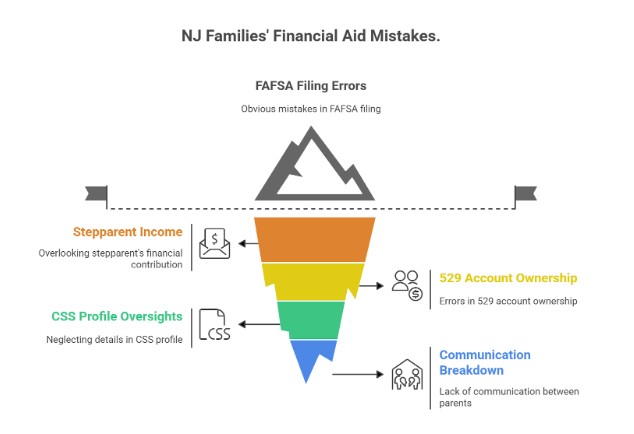

Common Mistakes NJ Families Can Avoid

Divorced families in New Jersey often make mistakes that can result in lost college funding opportunities.

Typically, these errors involve selecting the incorrect parent to file with or failing to consider how remarriage impacts aid calculations.

Mistake 1: Wrong Parent Files the FAFSA

Lots of families think the parent with legal custody should file. But the FAFSA uses a different rule for a custodial parent: it’s the parent the student lived with most in the past 12 months.

Parents should actually count the days in each house if it’s a tie, the parent who gave more financial support files.

Mistake 2: Ignoring Stepparent Income

When the custodial parent remarries, the stepparent’s income has to go on the FAFSA. This surprises many families and can reduce the amount of aid.

Think about the timing of remarriage. Filing before getting remarried can sometimes lead to better aid.

Mistake 3: 529 Account Ownership Errors

Non-custodial parents often keep 529 plans in their own names, not realizing distributions count as untaxed income to the student. That can double-penalize future FAFSA applications.

Transfer 529 ownership to the custodial parent before filing. Wait until after January 1 of sophomore year to use non-custodial parent 529 funds.

Mistake 4: CSS Profile Oversights

The CSS Profile needs both parents’ financial info, even if they’re divorced. Some families only send in custodial parent data, which leaves things incomplete.

Private colleges that use the CSS Profile have different methods for calculating aid, which consider both parents’ assets and income.

Mistake 5: Poor Communication Between Parents

Parents sometimes don’t discuss their financial decisions, missing opportunities to improve aid eligibility. They might also argue about who files forms or shares info.

It’s a good idea to create a written plan before your senior year. Decide who files and how you’ll handle college costs ahead of time.

Closing Thoughts

Divorce presents unique challenges for families navigating college financial aid. The rules have undergone significant changes lately, particularly with updates to FAFSA requirements.

Key changes include how families determine who is the custodial parent. Now, the parent who provides the most financial support fills out the FAFSA, not always the one with legal custody.

Divorced families need to be aware of the requirements for both the FAFSA and the CSS Profile. Some colleges stick with the FAFSA, while others require additional information through the CSS Profile.

Planning can make a real difference. If you’re considering significant financial moves, such as remarriage, timing is crucial. These choices might affect your student’s aid eligibility for quite a while.

Parents need to maintain open lines of communication. Sometimes, both will have to provide information or documents during the process.

Professional guidance is often helpful when things become complicated. College funding coaches know the ropes and can help divorced families spot more aid opportunities.

The financial aid process demands attention to deadlines and requirements. If you miss the paperwork or submit incorrect information, you may delay your aid package.

Let Coastal Business Services navigate your FAFSA/CSS process post-divorce so you maximize aid and reduce stress. Contact Us to schedule.

If you’re ready to get started, call us now!

Frequently Asked Questions

Which parent completes FAFSA after a divorce in New Jersey?

In New Jersey, the FAFSA must be completed by the parent who provided more than half of the student’s financial support during the past 12 months. If that parent is remarried, their spouse’s (stepparent’s) income and assets must also be included in the application.

Do both divorced parents go on the FAFSA?

No, neither divorced parent goes on the FAFSA. Only the support-based parent is listed—the one providing more than 50% of financial support. However, if divorced parents continue living together, FAFSA requires income and assets from both to be reported.

Does FAFSA count child support in New Jersey?

Yes. Starting with the new FAFSA, child support received is reported as a parent asset, rather than untaxed income. Families in New Jersey must calculate the total received during the last full calendar year. Child support paid is no longer reported on FAFSA.

How is the CSS Profile different from FAFSA for divorced parents?

Unlike FAFSA, which generally requires one parent’s financial information, the CSS Profile often requires income and asset details from both custodial and noncustodial parents. This broader view can impact eligibility for aid. Some schools allow noncustodial parent waivers in cases of no contact.

Can I get a CSS waiver for my noncustodial parent?

Yes. Many colleges allow a Noncustodial Parent Waiver if you can prove the noncustodial parent does not provide financial support or is unreachable. Documentation, such as court orders or proof of no contact, is typically required, and the institution determines approval.

What happens if the FAFSA parent remarries?

If the FAFSA parent remarries, their new spouse’s (stepparent’s) income and assets must also be included on the FAFSA. The CSS Profile typically requires information from both households. This rule can reduce eligibility for need-based aid, depending on total household finances.

Does divorce timing affect FAFSA or CSS Profile?

Yes. The FAFSA and CSS Profile use prior-prior year tax data, which may not accurately reflect current realities after a recent divorce or custody change. Families can request a professional judgment review from each college’s financial aid office to update information and eligibility.

What extra steps do NJ families take for financial aid?

New Jersey families must create an NJFAMS account after submitting the FAFSA to access state-based aid, such as the Tuition Aid Grant (TAG). NJFAMS allows parents and students to upload required documents, track deadlines, and resolve verification tasks directly with the state.