Modern businesses are choosing remote financial leadership because it’s flexible, cost-effective, and allows them to access top-level expertise from anywhere.

Companies aren’t stuck hiring a CFO who sits in a corner office anymore. Virtual CFOs now support accounting, financial planning, and growth, usually at a cheaper rate than hiring in-house.

Remote financial leaders help organizations set goals and create forecasts. With secure digital tools, they oversee finances and offer guidance just as well as someone on-site.

Businesses can hire talent regardless of location, which means access to better skills and advice.

Key Takeaways

- Remote CFOs deliver expert financial guidance from anywhere.

- Businesses save money and reach a wider pool of skilled leaders.

- Virtual financial leadership brings flexibility without sacrificing quality.

The Rise of Virtual Financial Leadership

Virtual financial leadership is changing how companies manage money and make decisions. Businesses use remote expertise and modern tech to support growth from anywhere.

From Corner Office to Cloud-Based Strategy

The old-school image of a CFO in a city office? It’s fading fast. Companies of all sizes now turn to cloud-based CFO support for faster access to financial expertise.

Small businesses can tap into specialized skills that used to be reserved for big corporations. For example, they might hire a fractional CFO who works part-time from anywhere.

This means smarter spending since businesses only pay for what they need. Cloud tools let remote finance teams track budgets, cash flow, and forecasts in real time.

With secure platforms, CFO consulting for startups and growing businesses happens online, making data sharing easy. Video meetings and quick messages keep everyone connected and speed up decisions.

Why Modern CFOs Don’t Need to Be On-Site

Remote financial leadership breaks down the location barrier. Companies can look beyond their city to find the best CFOs and finance experts.

Benefits for small business remote finance teams include:

- Lower costs, since there’s no need for office space

- Easy onboarding through digital platforms

- Fast access to reports and advice

Virtual CFOs handle everything from strategic planning to budgeting without being on-site. They offer flexible hours and scale their involvement up or down as needed.

This is especially valuable for startups that need CFO consulting but can’t afford a full-time hire.

Looking for strategic financial direction without hiring in-house? Schedule a free virtual CFO consultation with Coastal Business Services and get the leadership your numbers—and growth—deserve.

If you’re ready to get started, call us now!

Key Benefits of Remote CFO Services

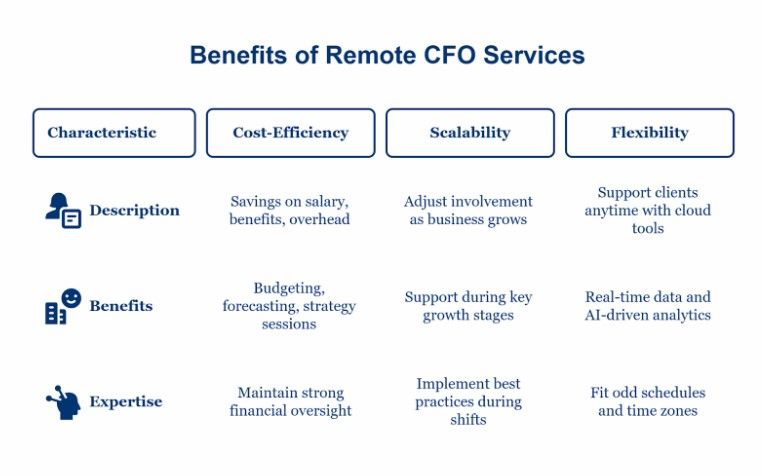

Remote CFO services give businesses actionable financial leadership without the cost or risk of a full-time hire.

Modern tools make it easy to get professional financial management and respond quickly to changing needs.

Cost-Efficiency Without Compromise

Lots of businesses want CFO-level expertise but don’t want the price tag of a full-time exec. Virtual CFO services are usually part-time or contract-based.

Companies pay only for what they need—budgeting, forecasting, or strategy sessions. This setup saves on large salaries, benefits, and overhead.

Small and growing companies receive advanced financial support while keeping their budgets in check. By outsourcing CFO services, organizations maintain strong financial oversight without losing quality or accuracy.

Scalability for Growth-Minded Companies

Remote CFOs adjust their involvement as a business grows. They handle changing needs, whether it’s setting up accounting for a startup or helping a company scale and plan for expansion.

A virtual CFO often suggests and implements best practices during business shifts. These experts guide everything from daily cash flow to complex fundraising or mergers.

Key benefits include:

- Support during key growth stages

- Help with new product launches or entering new markets

- Adjusting financial controls as teams expand

Flexibility and Real-Time Availability

Virtual CFOs work remotely and use the latest cloud accounting tools. They can support clients anytime, not just 9-to-5.

With real-time data and AI-driven analytics, they deliver up-to-date insights, which help businesses react quickly to challenges or opportunities.

This constant connection might mean quick check-ins, emergency calls, or fast financial updates.

Virtual CFO services fit odd schedules and time zones, giving businesses steady guidance wherever they are.

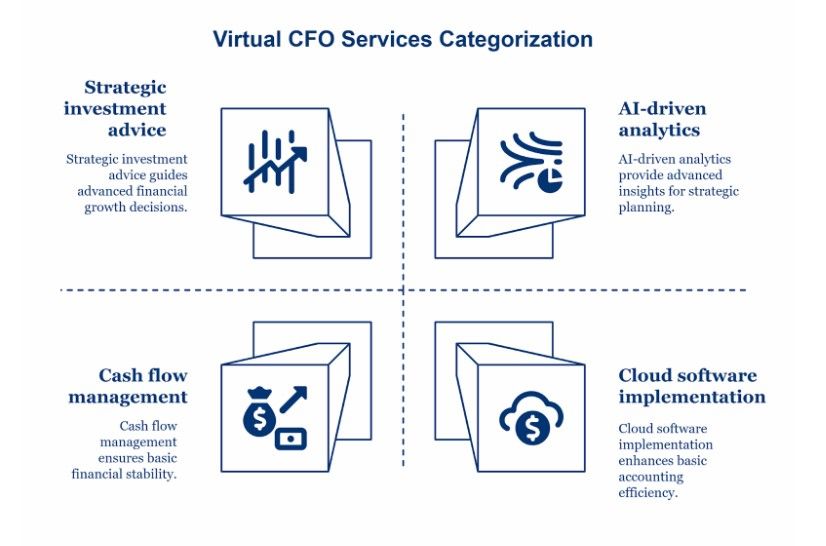

What Virtual CFOs Actually Do

Virtual CFOs go way beyond basic accounting. They help leaders with remote financial planning and advise on business growth.

Beyond Bookkeeping—Strategic Guidance

A virtual CFO isn’t just an accounting pro. They help steer a company’s financial direction, offering advice on where to invest, when to save, and how to manage cash flow.

These professionals learn business goals and help make forecasts and budgets that support growth. For many, they act as partners who help leaders pick smart paths for expansion.

Virtual CFOs provide input on major decisions, such as launching products or entering new markets. Their strategic guidance helps companies manage risks and spot opportunities.

They provide virtual financial strategy consulting and help set targets that move the business forward.

Tech-Driven Decision Support

Modern virtual CFOs use cloud software and automation to ensure the accuracy of financial data. They also rely on tools that let leaders track performance and see results online.

With these tech tools, remote CFOs spot trends and alert teams to issues before they become major. They use AI-driven analytics to provide clear, quick insights.

Companies appreciate how these experts make data easy to understand. Their tech skills support better decisions and smoother planning. This approach lets businesses adapt quickly, which is one big reason so many choose remote financial leadership.

Not sure if your finances are investor-ready? Contact Coastal Business Services today to explore flexible, remote financial planning solutions tailored to your next phase of growth.

If you’re ready to get started, call us now!

Overcoming Common Concerns About Remote Financial Leadership

Remote financial leadership brings real benefits, but businesses worry about data safety, regulations, and productivity.

Strong systems, clear guidelines, and modern communication tools help teams manage these issues and maintain trust.

Security & Compliance

Security is a top concern for companies considering virtual CFO services. Financial data needs protection from threats and accidental leaks.

A secure virtual finance team protects sensitive information through encrypted communication, multi-factor authentication, and private document storage. Companies also rely on VPNs, firewalls, and secure cloud software to keep records safe.

Regular staff training on safe online practices helps reduce risk from human error. Following strict data compliance rules like GDPR or HIPAA is also key, especially in regulated industries.

Regular audits and clear accountability build trust in remote setups. With the right protocols, remote teams can match or even beat the data safety of traditional on-site departments.

Communication and Accountability

Clear communication is crucial with remote financial leaders. Regular video meetings, shared dashboards, and project management apps make tracking progress and solving problems easy.

Setting clear roles, deadlines, and performance metrics supports accountability. Remote CFO services use detailed reports, live document sharing, and real-time updates to show how goals are being met.

Open feedback and check-ins keep everyone informed and engaged. This helps businesses avoid the communication gaps that sometimes crop up in remote work.

Is a Virtual CFO Right for Your Business?

Many companies wonder if remote financial leadership can match the value of an in-house CFO.

With new tech, changing work habits, and cost pressures, more businesses are considering virtual solutions that deliver expert advice and strategic planning.

When to Consider the Switch

A business might be ready for a virtual CFO when growth goals, complex finances, or new investments pile up and need extra attention.

If you’ve outgrown basic bookkeeping but cannot afford to hire a full-time CFO, this could be the perfect solution.

Virtual CFOs usually work part-time or on contract, so you only pay for what you actually use. It’s a flexible way to tap into high-level expertise without the hefty salary and benefits that come with a permanent hire.

How do you know if it’s time?

Here are a few signs:

- Budgeting, forecasting, or cash flow feels overwhelming

- You’re gearing up for rapid growth or expansion

- Raising capital or managing investor relationships sounds daunting

- You want regular, up-to-date financial reports

Let’s look at how remote and in-house CFOs stack up:

| Feature | Virtual CFO | In-House CFO |

| Work Arrangement | Remote, flexible | On-site, full-time |

| Cost | Part-time/contract | Full salary & benefits |

| Setup Needs | Minimal | Office/resources needed |

| Expertise Access | As needed | Ongoing, on payroll |

Coastal Business Services: Virtual Leadership, Real Results

Coastal Business Services offers virtual CFO support to companies that want expert guidance but don’t want to hire a traditional CFO.

Their remote team can jump in to create financial strategies, oversee accounting, and handle planning, without showing up at your office every day.

With Coastal’s model, you get the skills of a seasoned finance chief and keep things flexible with contracts. Services might cover monthly financial reviews, forecasting, risk assessment, and compliance help.

Virtual CFOs use technology to keep your information current and secure. That’s just how things work these days.

Plenty of Coastal clients have noticed faster decision-making and much clearer financials after bringing on a virtual CFO.

This approach really shines for small or growing businesses that want strategic financial guidance without the full-time price tag.

As your priorities shift, this remote leadership can quickly adjust support to match your needs. That kind of flexibility is tough to beat.

Conclusion

Businesses are turning to virtual financial leaders for their flexibility and expertise. A virtual CFO can offer strategic support without needing to be on-site.

Remote finance pros can access top talent from just about anywhere, making finding people with the right skills and experience easier.

Companies also notice stronger employee loyalty and a more diverse company culture, thanks to remote work opportunities.

Cost savings play a big role, too. Businesses can cut or even remove real estate expenses, saving real money and resources.

Less time in the office usually means fewer interruptions and more focused work. That can help leaders make sharper decisions.

Flexible work arrangements are a hit with employees. Many say they feel less fatigued and burned out, which makes them more productive and happier with their jobs.

This shift helps companies build stronger teams and get better results. It’s not hard to see why remote finance leadership is catching on with modern businesses.

Why wait to upgrade your financial strategy? Book your virtual CFO call now with Coastal Business Services and start leading with data, not just instinct.

Contact Us Today For An Appointment

Frequently Asked Questions

What is a virtual CFO?

A virtual CFO is a remote financial professional who provides strategic leadership, financial planning, forecasting, and reporting, without being employed full-time or working on-site.

How does a remote CFO service work?

Remote CFOs work via cloud-based tools, offering financial insights and reports, as well as planning through virtual meetings, dashboards, and secure document sharing, keeping your business financially agile.

Why are businesses switching to virtual financial leadership?

Businesses are choosing virtual CFOs to save on costs, gain flexible access to financial expertise, and improve strategic planning without the overhead of a full-time executive.

Are virtual CFOs secure and compliant?

Yes. Virtual CFOs use encrypted, cloud-based accounting platforms and follow strict data protocols to ensure financial records remain secure and compliant with industry standards.

What services do virtual CFOs typically offer?

Virtual CFOs provide forecasting, cash flow analysis, financial reporting, budgeting, tax strategy, capital planning, and investor readiness—all remotely and on demand.

How much does a virtual CFO cost?

Virtual CFOs typically cost 50–70% less than in-house CFOs. They offer packages based on business size and needs, with services scaled up or down as required.

When should a small business hire a virtual CFO?

Hire a virtual CFO when you need strategic financial guidance, plan to raise capital, expand operations, or outgrow basic bookkeeping support. It’s a smart next step for scaling.