Most leaders see finance as just balance sheets and budgets. But these days, businesses need more than basic accounting to keep pace with change and uncertainty.

A strategic financial partner looks beyond the numbers to help guide tough calls, spot fresh opportunities, and shake up the business for the better.

Strong financial partners do a lot more than report results. They use their insight to spot trends and drive growth.

Companies like Amazon and Adobe rely on forward-thinking finance teams to uncover new business models and push innovation. Finance can help lead real change, not just keep score.

Strategic financial partners provide steady advice and clear direction when crisis or uncertainty strikes. They help leaders act quickly and confidently.

Key Takeaways

- Businesses need financial partners who drive decisions, not just count money.

- Strategic finance transforms traditional roles and adds measurable value.

- The right partner brings technology and insight to support business growth.

The Shift From Bookkeeping To Strategic Finance

Traditional accounting involves tracking past transactions. Strategic finance looks forward and aims to guide big business decisions.

As markets become more complex and growth becomes tricky, the strategic financial partner becomes crucial. Their role has grown significantly in recent years.

Traditional Accounting vs Strategic Financial Guidance

Traditional accounting focuses on recording, classifying, and reporting financial data. Bookkeepers track sales, expenses, and payroll, keeping records accurate for tax and compliance.

But these tasks only show what has already happened. They don’t identify risks, spot trends, or help plan for what’s next.

Business owners often realize that standard accounting doesn’t answer questions about expansion, pricing, or resource allocation. That’s where strategic partners step in.

A strategic financial partner goes further. They analyze financial trends, predict outcomes, and advise on growing the business.

CFOs and strategic advisors focus on profitability, cash flow forecasting, and competitive positioning. This shift helps organizations move from reacting to proactively making decisions.

Strategic accountants help companies move past simple bookkeeping by evaluating financial patterns and forecasting outcomes.

Why Strategic Financial Partners Are Essential For Growth

As businesses grow, they need more than record-keeping. They face tough choices about investments, hiring, and new markets.

A strategic financial partner helps with these decisions by offering deep analysis and scenario planning.

Key benefits include:

- Data-driven budgeting

- Accurate forecasts

- Identifying profit opportunities

A financial advisory or an accounting firm with strategic services can design custom strategies for finance-led business growth.

Strategic financial partners work closely with the management team, giving advice that blends numbers with business context.

This partnership equips CEOs and leaders to make informed, long-term decisions. Companies that adopt a strategic finance approach gain insights to support transformation and growth.

Ready to stop guessing and start growing? Coastal Business Services offers strategic fractional CFO services that align your financial vision with real-world business results. Let’s build smarter—starting today.

If you’re ready to get started, call us now!

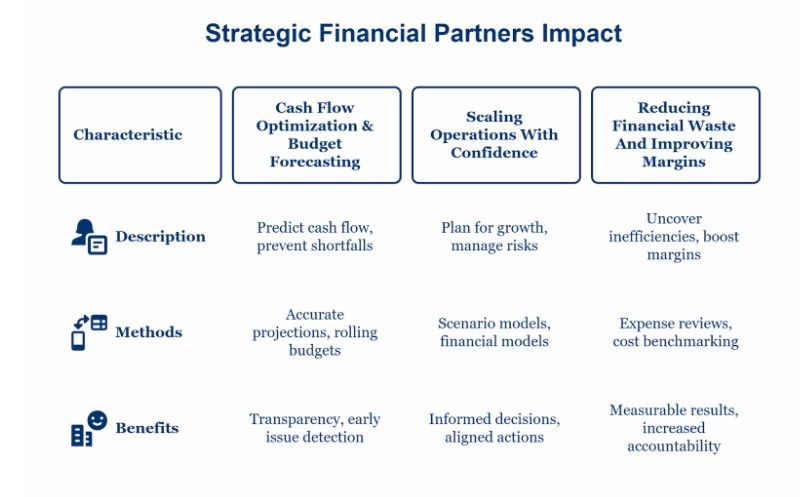

How Strategic Financial Partners Create Measurable Impact

Strategic financial partners help businesses use resources more effectively, cut risk, and spot new growth opportunities. Their targeted approach brings real value that goes way beyond routine accounting.

Cash Flow Optimization & Budget Forecasting

Effective cash flow management is crucial for any business. Strategic financial partners, like a cash flow strategy consultant, use accurate projections and rolling budgets to help leaders predict low cash periods and prepare in advance.

They use budget forecasting tools to prevent shortfalls and keep spending aligned with business goals. This lets teams make timely decisions and handle expenses with more control.

For small businesses, a financial planning expert can set up schedules and dashboards that show where money goes and what’s coming in. Better transparency makes it easier to catch issues early and avoid nasty surprises.

Scaling Operations With Confidence

Scaling a business puts pressure everywhere, from hiring to inventory. CFO-led transformation helps organizations plan for growth, manage new risks, and make smart investments.

A chief financial officer or strategic partner can build scenario models to test how changes might affect resources and staffing. This kind of planning eliminates guesswork by weighing costs and benefits before spending a dime.

Rolling forecasts and financial models give leaders the data they need to expand into new markets or launch products.

With a clear financial strategy, companies can align their moves with bigger goals and scale with more confidence.

Reducing Financial Waste And Improving Margins

A strategic approach to finance does more than just report numbers. It uncovers hidden inefficiencies, unnecessary spending, and missed chances to boost margins.

Regular expense reviews help businesses catch overspending fast. Financial partners might use expense analysis, cost benchmarking, or margin monitoring to find what’s hurting profits.

Business transformation financial strategy often means smarter procurement and renegotiating vendor contracts.

Cutting waste and focusing on high-margin offerings brings real, measurable results to the bottom line.

Financial teams set up systems to keep everyone accountable for spending and performance, so improvements stick around.

Strategic Advisory In Crisis & Conflict

Strategic financial partners offer expert guidance, objective analysis, and planning tools during crises and conflicts. Their support helps reduce uncertainty and keep the business stable.

Business Mediation During Partnership Disputes

When business partners disagree, the risk of stalled operations and financial loss increases. A strategic financial partner offers business conflict mediation services that bridge divides and help everyone reach agreements.

They provide clear financial assessments to show the real state of business assets, debts, and forecasted revenue. This helps partners decide based on data, not just emotions.

Typical mediation support includes:

- Reviewing partnership agreements

- Valuing the business accurately

- Setting up fair buyout or exit plans

- Facilitating tax planning for settlements

With objective financial mediation, businesses can often resolve disputes without going to court. That saves time, lowers costs, and keeps relationships intact.

Divorce & Business Continuity Planning

Divorce can threaten a business’s stability, especially when both spouses are involved. A strategic financial advisor skilled in divorce financial planning for business owners prepares an impartial valuation and reviews ownership setups.

Clear tax planning and a plan for dividing wealth help keep the business running. The advisor may design a buyout or set up trusts to handle ownership transfers in a way that works for both sides.

They also address business succession, so the company won’t be left hanging during or after the divorce.

By balancing personal and company needs, the right financial partner cuts conflict and keeps the business steady.

Navigating Economic Uncertainty

Economic crises can bring sudden revenue drops, new regulations, or big market swings.

Strategic financial partners provide crisis management services to help leaders react quickly and adjust operations for survival.

They use scenario planning to model best-case, worst-case, and base-case outcomes. Advisors update cash flow projections and suggest cost-control moves for both short and long-term needs.

Support may include negotiating with creditors, adjusting tax payments, and structuring emergency funding. Their expertise keeps companies ready for whatever comes next.

Are you facing a partnership split or internal conflict? Coastal Business Services provides business mediation that keeps your company stable and focused without dragging it through court. Find out how we resolve more than numbers.

If you’re ready to get started, call us now!

Technology + Insight: Financial Transformation Tools

Smart tech lets finance teams turn numbers into better decisions. Data analytics and automation are now must-haves for strategic financial management and growth.

Leveraging Data Analytics In Financial Forecasting

Financial forecasting has moved way past spreadsheets. Now, accurate forecasts rely on tools that use real-time data.

These platforms spot revenue, expenses, and cash flow patterns much faster than manual methods. Finance teams use dashboards to track KPIs like gross margin, operating costs, and sales trends.

This helps decision-makers see problems and opportunities sooner. For small businesses, it means more control and the ability to pivot quickly.

Machine learning tools are also making a difference. Algorithms can spot risks and predict cash shortfalls, allowing teams to avoid surprises.

Reliable forecasting helps companies set realistic goals, cut waste, and support growth. Cloud-based forecasting tools allow teams to share results and collaborate from anywhere.

Secure sharing boosts accuracy and speeds up planning. SAP S4HANA is a good example, offering instant access to financial data and supporting more agile moves by combining insights and automation in one platform.

Automation And Cost Efficiency

Automation is changing how finance teams work. Software now handles repetitive tasks like invoicing, payroll, and expense management, cutting errors and saving time.

Businesses save money because automation reduces manual work. It also frees up teams to tackle bigger problems, like strategy and business analysis.

Automating these tasks speeds up closing books and financial reporting. Small businesses especially benefit from affordable automation tools that connect to bank accounts and data sources, streamlining budgeting and forecasting.

Going digital can bring higher returns by making resource planning easier and cutting delays. The impact of digital finance transformation and automation shows up in teams looking for more efficiency.

Real-time reporting leads to faster reactions during market shifts, which is a real advantage in today’s business world.

Choosing The Right Strategic Financial Partner

Picking a financial partner can shape your company’s future. The right choice takes more than just expertise—it’s about finding someone who shares your commitment to strategic business goals.

Credentials That Matter

Relevant experience in the industry should be a non-negotiable for any financial partner. Credentials like a CPA or CFA show real depth in dealing with financial issues.

If you’re hiring fractional CFO services for a small business or thinking about outsourcing CFO services, ensure they’ve succeeded with similar clients. It’s just smart to check.

A strategic partner needs to bring more to the table than just bookkeeping. You want someone comfortable with profit analysis, cash flow forecasting, and financial modeling.

Here’s a quick table to help you size up candidates:

| Credential | Why It Matters | Example Task |

| CPA / CFA | Advanced financial skills | Financial analysis |

| Industry Expertise | Knows regulations and trends | Growth planning |

| Tech-savvy | Works well with software | Automation & reporting |

Aligning Financial Strategy With Business Vision

Any financial partner worth your time should understand and genuinely support your company’s mission.

The right financial partner for business owners aligns its strategy with long-term goals and stays flexible as needs shift.

This means having real conversations about where things are headed. There’s got to be honest feedback on what’s actually possible, not just what sounds good on paper.

If you’re running a start-up or trying to scale up, the best strategic financial advisor near me will not give you generic advice.

You want custom recommendations that fit your situation.

Here’s how a true partner lines up with your business vision:

- Linking financial plans to growth targets

- Helping set priorities for resource allocation

- Providing insights to back strategic decisions

It’s time to take your strategy beyond spreadsheets. Coastal Business Services delivers proactive tax planning that drives smarter decisions and long-term savings. Schedule your custom financial review today.

If you’re ready to get started, call us now!

Frequently Asked Questions

What does a strategic financial partner do?

A strategic financial partner helps businesses go beyond basic accounting by guiding long-term decisions related to budgeting, forecasting, risk management, and growth strategy.

How can fractional CFO services help a small business grow?

Fractional CFO services provide part-time, high-level financial leadership, offering insight into cash flow, profitability, and funding strategies without the cost of a full-time CFO.

Why is financial planning important for business transformation?

Financial planning aligns resources with growth goals. It enables businesses to scale efficiently, reduce waste, and respond confidently to economic changes or new opportunities.

What’s the difference between accounting and strategic finance?

Accounting tracks past performance and ensures compliance, while strategic finance focuses on future planning, scenario analysis, and improving financial decision-making across the business.

Can financial mediation protect a business during a divorce or dispute?

Yes. Financial mediation helps resolve disputes like divorce or partnership splits without court battles, protecting the business’s continuity and asset structure in the process.

When should a business hire a financial advisor or fractional CFO?

Hire a financial advisor or fractional CFO when facing rapid growth, cash flow issues, investor negotiations, or complex decisions that require strategic financial insight.

What tools do strategic financial partners use to support business decisions?

Strategic financial partners use tools like QuickBooks, NetSuite, and financial dashboards to deliver real-time insights, forecasts, and performance analysis that guide better decisions.